Building Wealth – Part 3

If you are a new salaried employee and if you have no idea on what strategies you can follow to build wealth, then this post is for you. There are many strategies out there to build wealth. This is just one of them.

Building Wealth Part 1 – Developing Financial Knowledge

Building Wealth Part 2 – Delayed Gratification

Regardless of whether you are going to follow this strategy or not, just be aware of it. Just learning about this strategy will give you many ideas to build your own strategy that fits your style.

We can divide our wealth building process into four different phases: Accumulation, Growth, Independent, and Abundant. All four phases make up the marathon “Wealth Building”.

Phase 1: Accumulation

Of all the phases, the accumulation phase is the most important one. What we do in this phase decides whether we are going to touch the finish line in our marathon or not. The goal of this phase is, as the name implies, accumulation. That means maximizing our savings by earning more, reducing our expenses and living as thrifty as possible. The word thrifty does not mean living a cheap life; it means using our hard earned money carefully instead of wastefully.

We already know the power of compounding. To maximize its potential, we need to give the invested money as much time as possible to grow. This is the phase to take full advantage of it as the money saved in this phase has the longest investment horizon.

When we start our career, we will most probably be a bachelor. We will have very little financial responsibilities. Expenses for absolute needs will be at the minimum. By default many choose to squander that advantage, and spend all their earnings on fancy things that give them temporary happiness, like buying an iPhone, a fancy motor bike, etc.

But a motivated person realizes that this is the golden period of their life for maximizing their savings. Saving 75% of our earnings is not an impossible feat during this phase. We can share accommodation, transportation etc. to cut down on the costs. We should at least shoot for 50% savings.

An important skill to learn in this phase is to differentiate between needs and wants. That is, understanding the difference between our absolute needs and our desires. This is not the phase to fulfill our desires.

We should focus only on our needs and should postpone our desires/wants to next phase. For example, the need for a vehicle to go to office is a “need”. If we buy a motor bike for Rs. 50,000 or less, then it is buying for need. Instead, if we convince ourself to buy an expensive Enfield bike for Rs. 2L, then it is buying for desire. It is to our benefit if we can avoid wants and desires like this in this accumulation phase.

I can hear you saying, “It is our childhood dream to buy a fancy motor bike when we start earning”. True. We all have our childhood dreams. For most of us, it is an emotional thing, because we grew up with a desire to own a fancy bike or a car. We even have it as a goal to buy a car/bike at least with a loan after joining the new job. It is more of an emotional impulse. In reality, the happiness for a new car/bike lasts for just one week. Maybe a couple more weeks. After that, it makes no difference – it’s just another bike.

So we have to ask ourself the question – what is important for me? Buy this fancy bike to feel the accomplishment for couple of weeks? or save and invest for future growth so that we can achieve financial freedom sooner in the life?

Remember – Building Wealth is a marathon, not a 100m sprint. Many consider building wealth as sprint, and to prove to the society that they are successful in life, they put their future in debt. Don’t be that person. If our goal is to impress the society, then we have to forget about the wealth building.

Cell phone is another example. Instead of buying the latest iPhone, we can easily buy a cheaper Motorola phone with the same features. Also, there is no need for upgrading phones every year. Upgrading it once in three to four years should be good enough. We should not be buying a phone for its features; we should buy based on our needs of the phone.

I am not suggesting that you kill your childhood dream – just that we don’t have to achieve it immediately. We can delay that for the next phase so that we can build a solid nest egg in this accumulation phase that helps in our wealth building.

Another drag in wealth building is buying a home in this accumulation phase. Many advise us to buy a home to save the money from paying rent. Ignore them, because they don’t have any clue about the price to rent ratio. Instead of paying the interest to the bank, paying rent is way cheaper, especially in India. We will cover this topic more in detail in another post. (Check out Buy Vs Rent episode in YouTube)

In short, this phase is like the life of a monk. That is, living a simple life without any luxury but having only savings as our focus. That does not mean that we have to live like a miser, but we should live a simple life without materialistic desires.

By the end of the accumulation phase, we should have saved and invested at least 5 times our annual expenses. Remember – if we are saving 50%, then we are spending only 50%. So it is faster to save 5 times our annual expenses than we think. At the max, it takes just 5 years. If we save 75% instead, we can do this even faster.

I can hear some of you saying, “All that is good. But I am close to 40. I cannot save 50 to 75% savings with my current expenses”. That is true. We cannot go back in time. But at least knowing this now can help you to come up with a plan to maximize your savings rate and to invest as much as possible.

Also, even if we feel like that we missed the bus already, we could at least teach our kids about the advantage of early accumulation. It is up to them whether they follow it or not. But they should definitely be aware of such an option.

Naturally the next question would be, what kind of assets should we invest in during this phase? Because this is the earliest phase, we got enough time before we retire. That means, we can afford to take the maximum risk. Because, even if the value of our assets go down in price in short term, it has enough time to recover and come up. And for that reason, we can invest in assets that has maximum return potential without worrying about its short term risk in this accumulation phase.

Just don’t go and bet it all on crypto. That would be a gamble. Equity (Stocks) would be a good option to invest in this accumulation phase. That does not mean that we should go and trade in individual stocks. Instead, buy an index fund. We will cover the topic of “How to build an equity portfolio” as the last post in this series.

In this phase, we don’t have to worry about “Asset Diversification”. We can handle it in next phase. So by the end of this phase we would have built a nest egg of at least “5 x annual expenses”. We should not touch this investment for any reason. This is going to be the base for our wealth building.

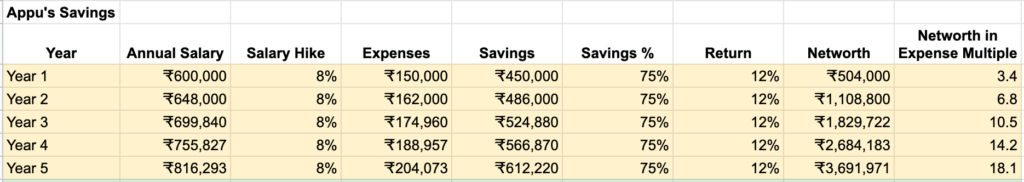

For example, if Appu earned Rs.50,000/mo, and if he was saving 75%, then his annual expense would be 1.5 Lakhs. Assuming that his earning go up up 8% every year, in 5 years, his nest egg would have grown to 37 lakhs for 12% annual growth.

Phase 2 – Growth

The next is growth phase. The goal of this phase is to grow the money saved and invested in “accumulation phase” to “25 x annual expenses”. This will be the longest of all the phases. But it is not a difficult one.

Most probably, we will get married in this phase. “Monk life” is not going to work after marriage. So we can get to our “normal life” in this phase. We can move into a separate one bed room apartment. We will have more responsibilities in this phase along with our expenses going up. But with at least 5 years of experience in our career, we will be in a good position to earn more as well.

Because we saved and invested aggressively in “accumulation phase”, it is not really necessary to be that aggressive with savings in this phase. Single income family can target 20% to 30% savings rate. Double income family, depending on their comfort level, they can target upto 50% savings rate. The equity investment that we did in accumulation phase, we should let it grow without touching it.

We can start diversifying and invest in other assets depending on our risk profile. We can buy a home for Real Estate exposure. But for buying a home, we should have saved at least 20% for downpayment. If we have not saved 20% for downpayment, that means we are not ready to buy a home yet. Remember, we should not be using the money saved in accumulation phase for this down payment. We should use only the earnings from this growth phase for down payment.

When we buy a home, we should buy for our needs. We should not be buying for our “desires”. That is – we should not be buying a home as big as that we can afford, but should be buying for our family size needs. It is better to wait till next phase for buying a bigger home. Because, bigger homes come with bigger expenses as package. Insurance, utilities bill, mortgage payment, property tax, maintenance cost – all shoots up with bigger homes.

We have to ask ourself the question of whether it is worth to pay that extra cost for that bigger home or is it better to invest that extra savings for wealth building? We have to make the decision based on our personal choice.

Next – our childhood dream car. We can fulfill that dream in this phase. That does not mean, we can buy luxury cars like Benz/BMW/Audi kinds. We are not ready for luxury yet. That comes in next phase. In this growth phase, a simple car – Maruti Swift kinds in India or Honda Accord / Toyota Camry kinds in USA – is the type of car we should be buying. The advantage of buying cars like these is, these are very reliable, Insurance and Maintenance cost are cheaper.

All these savings will help with our growth. Eagerness to buy an unique car in this phase will be detrimental to our growth. It is okay to be part of the crowd. This is not the time to be unique. We will take care of it in the next phase.

When it comes to debt, do not have any debt other than home mortgage. Any loan with interest rate more than 5% will hurt our financial growth. It is very cheaper to borrow in USA. We can get a house loan for less than 4% interest. We can also get a car loan for even less than 1%. But in India, the scenario is very different. Loan interest is very high. It is better to avoid any loans other than home loan in India.

In summary, we should do two things right in this phase.

- Not to touch the money invested during “accumulation phase”. Let it grow.

- Target and save at least 20% of our earnings as savings.

If we do these two right, assuming that we are achieving a 12% growth rate – we can pass this phase in 12-15 years. That is, we can achieve a net worth of 25 x annual expenses in 12-15 years. If our savings rate is higher than 30%, we could achieve this milestone even sooner. What does it mean if we have reached 25 x annual expenses as our net worth? “Financial Independence”.

So by the end of growth phase, we would have accumulated a net worth of at least 25 times our annual expenses.

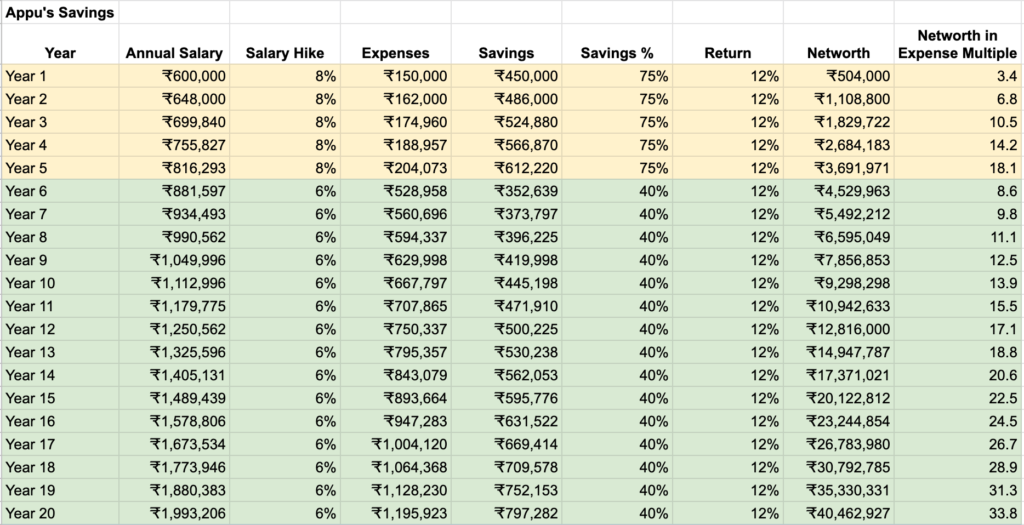

In our example, Appu’s 37 Lakh nest egg would have grown to 2.02 Cr in 15 years with no additional investment for 12% growth rate. But if Appu manages to save 40% during this phase, then by the end of year 20, he would have amassed 4.04 Cr – assuming a 6% increase in salary every year.

Phase 3 – Independent

Next is “Independent Phase” as we are financially independent now. For all the self controlled life that we have lived so far, we get to enjoy the benefits in this phase.

Now that we are financially independent, we are not tied by money any more. We do not have to compromise on things that we would have previously. This financial independence will give us the confidence to speak bold and to say and do the right things in the office. That empowerment will actually lead us to more responsibilities resulting in significant growth in career.

Now that we have a solid nest egg built by this time, we do not really have a need for savings. We have the freedom to spend all our earnings for luxury. The luxury car that we have been eyeing for a long time – now is the time to get it.

A bigger home? Sure. An international trip in business class? why not. In this phase, luxury expenses like these will not hurt our wealth building. We will have the total freedom to enjoy the luxury in this phase. But we have to be careful with one thing. All our expenses should be coming from our earnings. We should not touch our nest egg.

For 12% growth, this nest egg would double in 6 years. That means, we would have 50 times our annual expenses that we had by the end of growth phase. If we have not made any life style changes since the end of growth phase, we will have 50 times our annual expenses by now. But if we have upgraded our lifestyle to be a luxury one, we would be at 25 to 35 times the current annual expenses.

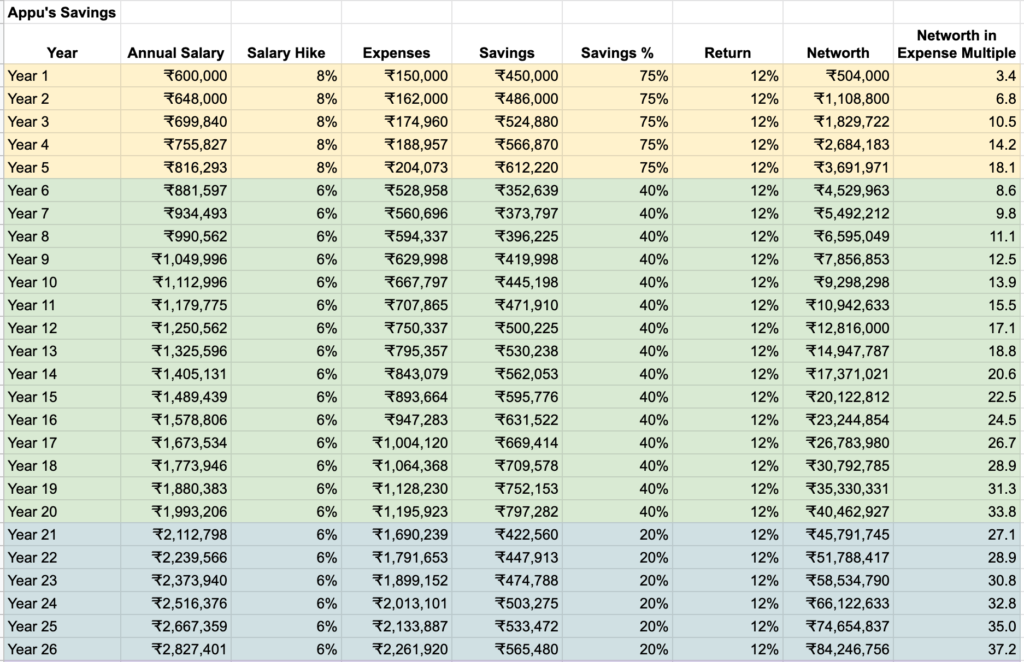

In our example, Appu’s nest egg would have grown from 4.04 Cr to 8.08 Cr with no additional contribution. But if he saved 20% in this phase, by the end of year 26, he would have 8.42 Cr as net worth – assuming a 6% increase in salary every year and a 12% annual return.

Phase 4 – Abundant

In this phase, it is not necessary for us to work to enjoy the luxury. Our investments will earn enough that we do not have to work for money to maintain our current life style. We will be making money doing nothing.

That does not mean sit idle at home. That would ruin both our physical and mental health. All this hard earned wealth will be for nothing then. We have to be both physically and mentally active at any age.

If we have built the wealth with this kind of dedication and focus, we will not be sitting idle after retirement. We will automatically start thinking about what we can offer for our community and we will start working on that. If you ask me, having an option to do something like that is what I call “Pure Luxury”.

So finally, if we look at how long it took us to build the wealth to support a comfortable life, it is just 26 years. If we have started this when we were 25 yrs old, we would have reached abundant phase by 51.

All this sounds good to hear – is this possible to execute it practically? I was able to do this by 42. But I was very aggressive with our savings and investments. You have to decide whether it would work out for you or not.

And one more thing. Appu’s example is to show the possibility. Not meant for mimicking exactly, as everyone’s situation is different with different salary, hike rate, savings %, risk profile etc. Knowing this possibility, come up with your own plan that fits your life style.

Good Luck!

If you find this post useful, please share it with your friends and family. Thank You.

Building Wealth Part 4: Long Term Thinking

Super Vijay all contant are brain hitting, Awesome, I feel you should do the demo, I dont know how it will, but kind of short flim in Tamil.

Also Tamil & English hard copy book should be published.

Great Job!!!

Very useful.Thanks for Yr effort in finance literacy to us.

Dear Vijay Mohan ji

U r amazing

U r one of the very few people who really want everyone to become wealthy..

Keep spreading the positive note to all

Thank u

Thank you sir.

Hi Vijay,

Thanks for writing such a wonderful article. A must read for everyone.

Great !!!

Excellant Vijay… incredible… i should have know this 10 years back.. still not late

i am 37 now and and started my investment journey 2021.. hoping to reach abundance by 59.

Thanks for awesome contribution.

Thk U for the valuable insights & guidance.

Thanks Vijay. It’s very useful to build the self confidence.