Is Roth 401K better than a Pretax 401K? Explained in detail with sample calculation.

Risks in Index funds

What are all the risks associated with Equity Index fund investing? This episode will prepare you on what to expect when you invest in an equity index fund.

What is an Index fund?

What is an Index fund? How does it work? What are all its advantages? All explained in detail.

“Explain Stock market like I am 12”

Stock market explained – if you have no idea about how stock market works, this episode is for you. This will help you to understand the basics of a stock market.

How to create a good Financial Plan

If you have no idea about financial planning and don’t know where to start, then you are at the right place. Following these 5 steps can help to build a good financial plan for your future.

Given the priorities in our life at different stages, most of us do not even get time to think about financial planning until our mid life. But if we are aware of the importance of having a financial plan at young age, we will definitely be in an advantageous position.

Step #1: Buy a Life Insurance

When it comes to financial planning, the first thing to do is, buying a life insurance.

Many I know, who is the sole bread winner for the family, do not have life insurance at all. They know that their whole family is dependent on their income. But still, they have not found the motivation to buy a life insurance for them yet.

Up until a tragedy strikes, we will not realize the seriousness of it. Few years ago, a family of dad, mom and a 6 year old son was living in the same apartment complex as me. The dad was just fine, but one day fell unconscious while shopping in Walmart. But he passed away on the way to the hospital in the ambulance.

His family was in total shock. Bigger shock is that he did not have any life insurance. It is just not the emotional stress of his loss for his family, but now they have to face the financial stress for the rest of their life as well.

We are seeing many incidents like this. At least one gofundme request coming in our whatsApp groups and facebook posts every week. But how long can a family survive with those funds?

Do not see life insurance as optional. It is a must. If loss of a family member will bring financial stress to the family, then that family member should definitely have a life insurance.

When it comes to life insurance, we should not be buying insurance products mixed with investments, like universal plan, endowment plan and ULIPs. We should be buying simple and straight forward Term Insurance. It is very cheap too.

Buying a term insurance is not complicated at all as we think. For more information on how to buy a term insurance, watch this episode. If you are in US, White Coat investor’s guide for buying term insurance is an excellent resource.

We should be buying Term insurance for a coverage of at least 25 times our annual expenses and for a term (period) till we retire. Do not skip buying life insurance just because you are already covered in your office. Their coverage can serve for only few years, which will not be enough for the family for their life time.

So when it comes to financial planning, regardless of whether you are doing other things or not, definitely buy life insurance.

Step #2: Pay Off Debt

Next thing to handle is “Debt”. While a debt could slow down the growth for some, it could totally destroy others.

Watch this episode to understand the difference between a good debt and a bad debt and also to learn some tricks to pay off debts faster.

It is not smart to invest for 8% return when we have a debt that sucks up 10% interest. That is why it is important to pay off our bad debts before proceeding to the next step in financial planning.

Step #3: Build an Emergency Fund

Our life never goes smooth as we expect. It always throws in few surprises and shocks here and there. An emergency fund will give us the safety cushion to handle those surprises.

At least have 6 months of expenses as emergency funds. Many think that they can handle all their emergency needs with their credit card. Bad idea. All the hard work we did in step 2 to get rid of the monkey “debt” will go waste. The debt monkey will be on our back again if we use the credit card for emergency.

I don’t know about you. But I would not like to carry around a monkey on my back. I will try my best to keep it as far as possible. Emergency fund will help with that.

Many ask the question of where to invest the emergency fund. Emergency fund is meant for handling emergency, not for investments. So always have the emergency funds in an easily accessible liquid accounts like in a savings account.

If you have completed the first 3 steps – buying a life insurance, paying off all bad debts and also have an emergency fund, then you can pat yourself on your back. Just doing these three will put you ahead of most in financial planning.

Step #4: Saving for Retirement

Most of us do not even think about saving for retirement until we hit 40. But by that time half of our life is gone.

As we saw in “Power of Compounding”, the sooner we save and invest for our retirement, the better the final growth amount will be. So do not take retirement planning for granted until it is too late.

Also remember the impact of inflation. Inflation rate in India is around 5% on average. That means, if our monthly expense is ₹50,000 now, then in 10 years, we would need ₹82,000 to maintain the same life style. In 20 years, the same need will become ₹1,33,000.

We should know how much to save Today and which assets to invest those savings so that we can generate an income of ₹1,33,000 per month after retirement. Saving just in a Fixed Deposit is not going to cut it.

We should learn to take calculated risks and invest in assets that has potential to beat the inflation. Watch this “Asset Allocation” episode to understand the risks and return potential of different assets in the market.

Having equity exposure is key to have enough money on our retirement. General rule for retirement savings is, invest your age % in assets like bonds (debt instruments) and (100 – your age) % in equity (stocks). If I am 40, I should have 60% of my portfolio in equity and 40% in other assets. Adjust those percentages to fit your comfort.

US residents can watch these 401K and IRA episodes to understand more about the retirement plans available in US.

If you need help building an equity portfolio, read this post.

Step #5: Saving for Children Education

Next in our priority list is saving for children education.

For all those emotional parents who give higher priority to saving for children education than to saving for their retirement, remember, there is always loan available for education, but not for retirement. We should not forget that fact.

Education cost inflation is about 8%, both in India and in USA. For our calculation purpose, it is better to assume the college fees to rise at a rate of 10% every year. A 5 lakhs cost Today would become 13 Lakhs in 10 years and 34 lakhs in 20 years.

Some of the YouTube episodes on this topic:

- Calculating Children Education needs and Investment options

- College Expenses in USA

- 529 Plan Explained (USA)

These are 5 critical steps in basic financial planning. We can take it to the next level by buying proper health insurance, writing will etc. We will cover those topics some other time.

Professional Financial Planners:

If you think that this basic financial planning itself is too complicated, then you definitely need a professional financial planner’s help. Don’t go to your bank’s regional manager or financial advisor. They will try to hit their sales target by selling products you do not need. To be fair, it is not their mistake. They are doing their job.

Look for fee only financial planners like here, who do not earn any commission from selling products. If you are in US looking for professional financial planning guidance, Mari from Samatva Wealth Management can help you.

Hope this is helpful. Don’t hesitate to share this with your friends and family. Thank You!

How to Build an Equity Portfolio

If you are new to equity (Stocks) investments and are not sure on how to build an equity portfolio, then this post is for you.

We can see this post as a natural extension of the “Building Wealth” series, as having a solid equity portfolio is the core of building wealth.

When it comes to equity investment, we should remember a couple of things.

- We should be investing in the stock market only with the money that we do not need for at least another 5 years. The stock market is very volatile. No one can predict the market movements in the short term. The only thing that we know is that the market has high chances of going up in the long term. That is all. So we should not invest the money that we would need in the short term in the stock market.

- The chances of us beating the Index by investing in individual stocks are very slim. Not even 1 person in 100 can do that consistently. So, avoid investing in individual stocks as much as possible. I am not discouraging you from investing in individual stocks. But if you are doing it, know your chances of consistently beating the index.

Risk Profiles

Even though we all have the same goal of adding equity exposure to our portfolio, our individual risk profiles are very different. Not everyone can follow the same template, as that would lead to disastrous results.

A low risk individual who would prefer to have least volatility in their portfolio should avoid following any high risk strategy. Investing in wrong risk profile will lead to making wrong decisions at the wrong time, hurting the growth of our portfolio.

That is why it is very important to understand our risk profile and then build a portfolio based on that.

At a high level, we can categorize risk profiles into Conservative, Moderate and Aggressive.

1. Conservative Equity Portfolio

When it comes to investment, conservative means having less exposure to risky assets and having more exposure to safer assets. But the “conservative” here refers to investing 100% in equity investments but with minimal volatility.

People who are new to stock market investing or who do not have time to monitor the market closely should invest conservatively. A salaried employee who is working full time should consider investing in the conservative category.

Conservative Portfolio for India

If you are in India, you can consider the following two index funds for conservative category.

- India’s Nifty 50 Index – 50%

- US’ Total Stock Market Index – 50%

Nifty 50 is the best index in India. The top 50 companies in India are in this index. Because India is a developing country and an emerging market, India’s growth can be expected to be greater than that of any developed countries. We can see the Nifty 50 Index as a proxy to India’s growth.

So if you believe in the growth of India, you can definitely believe in Nifty 50. On average, we can expect a return of around 11 to 13% from this index. On average does not mean that we can expect the return in this range every year. Stock market growth comes in sudden spurts rather than gradually.

Many fund houses offer the Nifty 50 Index. Go with ones that you like most. If you need help reading a mutual fund prospectus, watch this episode. It is important that you choose a direct fund rather than a regular fund to avoid higher fees.

If you would like to invest only in India, you can choose to invest 100% in Nifty 50 Index. But if you would like to have the exposure of the biggest stock market in the world, you can invest 50% in US’ Total stock market index fund offered by Navi.

We gain two advantages by investing in US stock market.

- Getting exposure to world’s best companies like Apple, Google, Tesla etc.

- Protection from Indian Rupees depreciation as the growth of US funds will be in US dollars. Even though the US market gives a return of 10 to 12% on average, it would become a 13 to 15% return in Indian Rupees.

We can expect an average return of 12 to 14% from this conservative portfolio.

Conservative Portfolio for USA

If you are in the US, you can buy just this one fund – Vanguard Total Stock Market Index (VTI/VTSAX) for the conservative category. There are around 3500 US companies in this index.

The guru of Index investing, John Bogle, once famously said, “Why search for a needle in a haystack when you can buy the whole haystack?” That is, instead of searching for the best performing stock, why not buy the whole market? This fund (VTI/VTSAX) is the best fund for conservative investors. On average, we can expect a return of 10 to 12% from this fund.

When it comes to equity investments, the conservative category has the least risk. It is a no brainer approach as we do not have to put that much effort in constructing or maintaining this portfolio. Whenever we have money to invest, we can just continue to invest in this conservative portfolio consistently. It is as simple as that.

That is why this is called the “Lazy Portfolio” in the market. If I had to recommend a portfolio to anyone, I would recommend this one. When compared to other assets, this one has the least risk with the greatest return potential.

Do not underestimate the risk on this portfolio just because it has minimal risk. During recession times, there are chances for this portfolio to go down by 50% or more. But as we saw in the “Recession” episode, that will eventually pass as well.

2. Moderate Equity Portfolio

If you are willing take on more risk than a conservative investor for potential higher returns, then you can consider this moderate portfolio.

But in this portfolio, the growth won’t be as smooth as in a conservative portfolio. We have to expect the ride to be a bit rough. That is, the value of this portfolio goes up and down more as it will have higher volatility. But the chances of this portfolio beating a conservative portfolio in the long term is higher.

Moderate Portfolio for India

- India’s Nifty 50 – 30%

- A managed fund – 30%

- US Nasdaq 100 – 40%

We can have 30% of Nifty 50 instead of the 50% in Conservative portfolio. Another 30% can be in a managed fund like Parag Parikh Flexicap or Canara Robeca Emerging Equities. Before buying a managed fund, we have to make sure that it has beaten the Index consistently in the long term, like in 5 to 10 years. Again, we need to be sure that we are buying the direct version of these funds to have minimal fees (expense ratio).

For US market exposure, the aggressive Nasdaq 100 can be bought for 40% instead of US total stock market index. The Nasdaq 100 index is top 100 non financial companies in US, with higher weightage to Technology sector. Nasdaq 100 has performed wonderfully in the last 10 years. On average, it has given a return of 16%. This growth has a good chance to continue into next decade as well. So we can expect a growth of 16 to 19% from Nasdaq in Indian rupees.

Watch this episode if you would like to understand the difference between S&P 500 and Nasdaq 100.

These percentages of allocation are just suggestions. You can adjust it to your comfort. We can expect a return of around 15 to 17% on average from this portfolio.

Moderate Portfolio for USA

For a moderate portfolio, US folks can reduce the total stock market index to 60%, and invest the rest in Nasdaq 100 Index ETF like QQQ. QQQ has given an average return of 16% in last 10 years.

Another option is to invest that 40% in Vanguard’s Technology Index – VGT. This one has around 350 companies compared to 100 in Nasdaq 100. But VGT has pure Technology companies though highly diversified within Technology. Nasdaq 100, on the other hand, has 50% exposure to Technology.

Depending on your risk tolerance and your sector preference, you can choose between VGT and QQQ or choose both.

On average, we can expect a return of around 13 to 14% from this portfolio.

3. Aggressive Equity Portfolio

If you are new to stock market investing, don’t even think about this category. Only people with at least 5 years of experience should consider this category. We need a deep understanding of the stock market to invest in this category.

We should have the knowledge of how different market sectors react in different economic situations to invest in this category. If we invest in the aggressive category without that knowledge, we will end up burning our fingers. So be mindful before venturing into this.

Another requirement for this category is that we have a complete understanding of the risk, as this one has the maximum risk. We should know how much additional risk we are taking before investing aggressively.

It is one thing to say that I can easily handle my portfolio going down by 50%, but it is totally a different thing to handle that when it actually happens. 99% of us cannot handle it. But 80% of us believe that we can.

So ask yourself this question. If your portfolio goes down from 1 Crore to 50 Lakhs in one month, what would be your reaction? If you believe that you can be normal, then you can invest aggressively. But if you say that you will lose your sleep over this, then sorry – you should not be investing in this category at all.

Portfolio recommendation is not needed for folks in this category. They would already know about it. If you are expecting a recommendation for this category, then that by itself tells you, that you are not ready for this category yet.

That is all to it in building a solid equity portfolio for long term investment. Good Luck!

Also, if you would like to know more about other good ETFs available in US market, you can check out this link.

Please feel free to share this post with your friends and family if you think that this can be beneficial for them. Thank You.

Long Term Thinking

Building Wealth – Part 4

Thinking in long term helps us to make informed decisions. Bill Gates once famously said, “Most people overestimate what they can achieve in a year and underestimate what they can achieve in ten years.” With the plans that we have put in motion now, we all have a rough idea of where we are headed in next year. But not many of us are capable of thinking where we would be in the next 10 years in terms of career growth, income growth or net worth growth.

Building Wealth Part 1:

Developing Financial KnowledgeBuilding Wealth Part 2:

Delayed GratificationBuilding Wealth Part 3:

4 Phases of Building Wealth

It helps to have a rough map of where we are headed in the long term. Of course, nothing will go exacly as per the plan. But in our journey, at least we will know how we are doing compared to our base line plan.

Possibilities in India

For good long term planning, we need to understand the possibilities in the long term. If we have ₹10 Lakhs available now for investing, is it possible to grow that money to ₹100 Crores in our life time? When we see a number like 100 crores, we immediately laugh and say no, thinking that it is impossible.

Let’s do a quick experiment to check your exponential thinking capability. If you invest ₹1 lakh now and if that one lakh doubles every 5 years, how much would you have by the end of 50 years? Take a guess and write your guess down on some paper.

If you have read the “Power of Compounding” post, you would have answered immediately that 1 Lakh would have grown 1000 times to 10 Crores by the end of 50 years.

For an investment to double every 5 years, we need a growth rate of 15%. If you are wondering whether it is possible to achieve a growth rate of 15%, Indian stock market Index Sensex has grown at a rate of 16% in the last 43 years.

If we include the dividends, then the return would have been 17-18%. So a total return of 15% return is not impossible. If ₹1 Lakh can grow to 10 Crores in 50 years, then you can imagine the growth of its multiples. ₹10 lakhs would have grown to 100 Crores in 50 years with no additional investment.

So if we have saved and invested ₹10 Lakhs by 35 years old, by 85 we could potentially have ₹100 Crores. That 100 crores does not look that big at all now, does it? It is an achievable target in our life time.

I am giving this example to show the possibilities. For estimation purposes, it is better to assume 10-12% growth every year, or even less, depending on our risk profile.

When it comes to investment, we should start thinking in long term. For a given return rate, how much would our invested money have grown in 5 years? 10 years? 20 years? 50 years? Use the compound interest calculator to get a rough idea of what to expect in the future.

Thinking in long term helps to make the right decisions now. Without knowing the growth potential, we will be tempted to spend it all now. When we understand the opportunity cost of that spending and the long term growth potential of that money if saved, we can make an informed decision on whether to move forward with that spending or not. This will also help us think twice before jumping on certain life style upgrades.

Rule of 72

There is an easy way to calculate the long term growth potential- the Rule of 72. This rule basically tells us on how long it would take for an investment to double. When 72 is divided by the expected return rate, we get the years it takes for our investment to double. If our return rate is 12%, then 72/12 = 6 years will be the time period it takes for our investment to double.

If the return rate is 15%, then our investment would double in 5 years. Depending on our targeted return rate, we should be able to calculate how long it takes for our investment to double. Once we know that, we can easily plan for our growth down the road in the future.

Possibilities in USA

We now know that Rs. 100 Crore is possible to achieve in India in our life time. How about the US? In US, we see a million as a very big amount of money. As the popular saying goes, the first million is the hardest- the rest is easy.

Minimal Investor has explained very well on how we could have achieved 1 million in the last decade with an example. If planned right, a single income family can achieve 5 million by retirement age. A double income family can achieve 10 to 20 million.

In fact, an aggressive saver and a smart investor could even make 1 billion in their life time. What does our brain think immediately after hearing the word “1 billion”? It must be saying – “Impossible- there’s no way”. That is because we have not trained our brain for long term thinking yet.

Lets take a look at an extreme example now. I am calling it extreme because it is a rare combination – an aggressive saver and a smart investor. I am giving this example just to show the possibilities, not to give false hope.

Just as Minimal Investor shared in his post, if we have started at 30, we would have 1 Million by 40. Let’s say, that by that time we have gained enough financial knowledge to know how to achieve 15% growth rate, yeah, that’s a pretty big if. But I already told you- this is an extreme example.

If our investment is growing at the rate of 15%, our investment would double every 5 years. Then how long would it have taken for 1 million to grow 1000 times to 1 billion? Like we already saw, it would have taken 50 years. Yeah, we will be 90 by then. I don’t know about you, but I am planning on living at least till 100. So 1 billion in our life time is possible. Is it possible for everyone though? No. Because achieving 15% return rate comes with its own risk. We will see about that more in future posts.

The reason I am giving this extreme example is to show that millions or billions are not as big of a number as we think. A normal person with focus and determination can achieve this in their life time. We don’t have to invent anything ground breaking to achieve that.

When we know our long term potential and understand the long term impact of each financial decision that we make now, we put ourself in a huge advantageous position. Start tracking your networth every year and identify your growth rate. Project that growth to next 10 years and more. If the growth is not to your expectation in coming years, then either reset your expectations or change your long term strategy.

If you find this post useful, please share it with your friends and family. Thank You.

4 Phases of Building Wealth

Building Wealth – Part 3

If you are a new salaried employee and if you have no idea on what strategies you can follow to build wealth, then this post is for you. There are many strategies out there to build wealth. This is just one of them.

Building Wealth Part 1 – Developing Financial Knowledge

Building Wealth Part 2 – Delayed Gratification

Regardless of whether you are going to follow this strategy or not, just be aware of it. Just learning about this strategy will give you many ideas to build your own strategy that fits your style.

We can divide our wealth building process into four different phases: Accumulation, Growth, Independent, and Abundant. All four phases make up the marathon “Wealth Building”.

Phase 1: Accumulation

Of all the phases, the accumulation phase is the most important one. What we do in this phase decides whether we are going to touch the finish line in our marathon or not. The goal of this phase is, as the name implies, accumulation. That means maximizing our savings by earning more, reducing our expenses and living as thrifty as possible. The word thrifty does not mean living a cheap life; it means using our hard earned money carefully instead of wastefully.

We already know the power of compounding. To maximize its potential, we need to give the invested money as much time as possible to grow. This is the phase to take full advantage of it as the money saved in this phase has the longest investment horizon.

When we start our career, we will most probably be a bachelor. We will have very little financial responsibilities. Expenses for absolute needs will be at the minimum. By default many choose to squander that advantage, and spend all their earnings on fancy things that give them temporary happiness, like buying an iPhone, a fancy motor bike, etc.

But a motivated person realizes that this is the golden period of their life for maximizing their savings. Saving 75% of our earnings is not an impossible feat during this phase. We can share accommodation, transportation etc. to cut down on the costs. We should at least shoot for 50% savings.

An important skill to learn in this phase is to differentiate between needs and wants. That is, understanding the difference between our absolute needs and our desires. This is not the phase to fulfill our desires.

We should focus only on our needs and should postpone our desires/wants to next phase. For example, the need for a vehicle to go to office is a “need”. If we buy a motor bike for Rs. 50,000 or less, then it is buying for need. Instead, if we convince ourself to buy an expensive Enfield bike for Rs. 2L, then it is buying for desire. It is to our benefit if we can avoid wants and desires like this in this accumulation phase.

I can hear you saying, “It is our childhood dream to buy a fancy motor bike when we start earning”. True. We all have our childhood dreams. For most of us, it is an emotional thing, because we grew up with a desire to own a fancy bike or a car. We even have it as a goal to buy a car/bike at least with a loan after joining the new job. It is more of an emotional impulse. In reality, the happiness for a new car/bike lasts for just one week. Maybe a couple more weeks. After that, it makes no difference – it’s just another bike.

So we have to ask ourself the question – what is important for me? Buy this fancy bike to feel the accomplishment for couple of weeks? or save and invest for future growth so that we can achieve financial freedom sooner in the life?

Remember – Building Wealth is a marathon, not a 100m sprint. Many consider building wealth as sprint, and to prove to the society that they are successful in life, they put their future in debt. Don’t be that person. If our goal is to impress the society, then we have to forget about the wealth building.

Cell phone is another example. Instead of buying the latest iPhone, we can easily buy a cheaper Motorola phone with the same features. Also, there is no need for upgrading phones every year. Upgrading it once in three to four years should be good enough. We should not be buying a phone for its features; we should buy based on our needs of the phone.

I am not suggesting that you kill your childhood dream – just that we don’t have to achieve it immediately. We can delay that for the next phase so that we can build a solid nest egg in this accumulation phase that helps in our wealth building.

Another drag in wealth building is buying a home in this accumulation phase. Many advise us to buy a home to save the money from paying rent. Ignore them, because they don’t have any clue about the price to rent ratio. Instead of paying the interest to the bank, paying rent is way cheaper, especially in India. We will cover this topic more in detail in another post. (Check out Buy Vs Rent episode in YouTube)

In short, this phase is like the life of a monk. That is, living a simple life without any luxury but having only savings as our focus. That does not mean that we have to live like a miser, but we should live a simple life without materialistic desires.

By the end of the accumulation phase, we should have saved and invested at least 5 times our annual expenses. Remember – if we are saving 50%, then we are spending only 50%. So it is faster to save 5 times our annual expenses than we think. At the max, it takes just 5 years. If we save 75% instead, we can do this even faster.

I can hear some of you saying, “All that is good. But I am close to 40. I cannot save 50 to 75% savings with my current expenses”. That is true. We cannot go back in time. But at least knowing this now can help you to come up with a plan to maximize your savings rate and to invest as much as possible.

Also, even if we feel like that we missed the bus already, we could at least teach our kids about the advantage of early accumulation. It is up to them whether they follow it or not. But they should definitely be aware of such an option.

Naturally the next question would be, what kind of assets should we invest in during this phase? Because this is the earliest phase, we got enough time before we retire. That means, we can afford to take the maximum risk. Because, even if the value of our assets go down in price in short term, it has enough time to recover and come up. And for that reason, we can invest in assets that has maximum return potential without worrying about its short term risk in this accumulation phase.

Just don’t go and bet it all on crypto. That would be a gamble. Equity (Stocks) would be a good option to invest in this accumulation phase. That does not mean that we should go and trade in individual stocks. Instead, buy an index fund. We will cover the topic of “How to build an equity portfolio” as the last post in this series.

In this phase, we don’t have to worry about “Asset Diversification”. We can handle it in next phase. So by the end of this phase we would have built a nest egg of at least “5 x annual expenses”. We should not touch this investment for any reason. This is going to be the base for our wealth building.

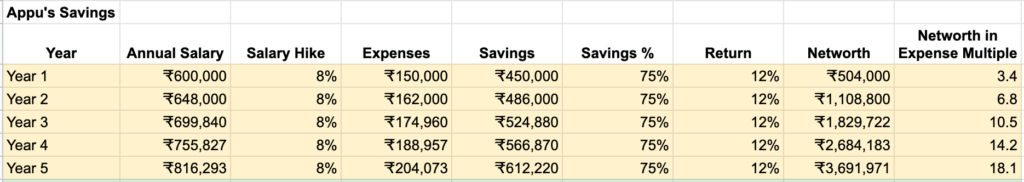

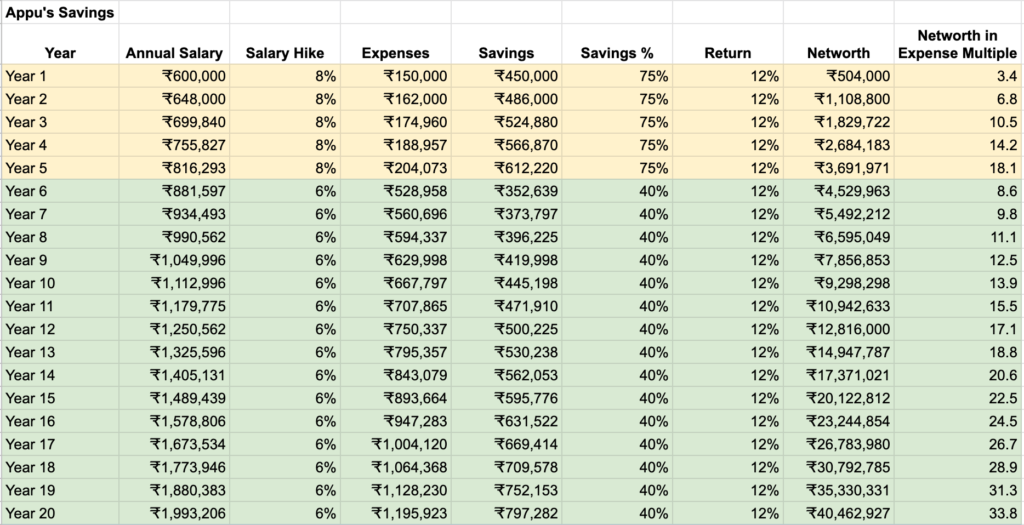

For example, if Appu earned Rs.50,000/mo, and if he was saving 75%, then his annual expense would be 1.5 Lakhs. Assuming that his earning go up up 8% every year, in 5 years, his nest egg would have grown to 37 lakhs for 12% annual growth.

Phase 2 – Growth

The next is growth phase. The goal of this phase is to grow the money saved and invested in “accumulation phase” to “25 x annual expenses”. This will be the longest of all the phases. But it is not a difficult one.

Most probably, we will get married in this phase. “Monk life” is not going to work after marriage. So we can get to our “normal life” in this phase. We can move into a separate one bed room apartment. We will have more responsibilities in this phase along with our expenses going up. But with at least 5 years of experience in our career, we will be in a good position to earn more as well.

Because we saved and invested aggressively in “accumulation phase”, it is not really necessary to be that aggressive with savings in this phase. Single income family can target 20% to 30% savings rate. Double income family, depending on their comfort level, they can target upto 50% savings rate. The equity investment that we did in accumulation phase, we should let it grow without touching it.

We can start diversifying and invest in other assets depending on our risk profile. We can buy a home for Real Estate exposure. But for buying a home, we should have saved at least 20% for downpayment. If we have not saved 20% for downpayment, that means we are not ready to buy a home yet. Remember, we should not be using the money saved in accumulation phase for this down payment. We should use only the earnings from this growth phase for down payment.

When we buy a home, we should buy for our needs. We should not be buying for our “desires”. That is – we should not be buying a home as big as that we can afford, but should be buying for our family size needs. It is better to wait till next phase for buying a bigger home. Because, bigger homes come with bigger expenses as package. Insurance, utilities bill, mortgage payment, property tax, maintenance cost – all shoots up with bigger homes.

We have to ask ourself the question of whether it is worth to pay that extra cost for that bigger home or is it better to invest that extra savings for wealth building? We have to make the decision based on our personal choice.

Next – our childhood dream car. We can fulfill that dream in this phase. That does not mean, we can buy luxury cars like Benz/BMW/Audi kinds. We are not ready for luxury yet. That comes in next phase. In this growth phase, a simple car – Maruti Swift kinds in India or Honda Accord / Toyota Camry kinds in USA – is the type of car we should be buying. The advantage of buying cars like these is, these are very reliable, Insurance and Maintenance cost are cheaper.

All these savings will help with our growth. Eagerness to buy an unique car in this phase will be detrimental to our growth. It is okay to be part of the crowd. This is not the time to be unique. We will take care of it in the next phase.

When it comes to debt, do not have any debt other than home mortgage. Any loan with interest rate more than 5% will hurt our financial growth. It is very cheaper to borrow in USA. We can get a house loan for less than 4% interest. We can also get a car loan for even less than 1%. But in India, the scenario is very different. Loan interest is very high. It is better to avoid any loans other than home loan in India.

In summary, we should do two things right in this phase.

- Not to touch the money invested during “accumulation phase”. Let it grow.

- Target and save at least 20% of our earnings as savings.

If we do these two right, assuming that we are achieving a 12% growth rate – we can pass this phase in 12-15 years. That is, we can achieve a net worth of 25 x annual expenses in 12-15 years. If our savings rate is higher than 30%, we could achieve this milestone even sooner. What does it mean if we have reached 25 x annual expenses as our net worth? “Financial Independence”.

So by the end of growth phase, we would have accumulated a net worth of at least 25 times our annual expenses.

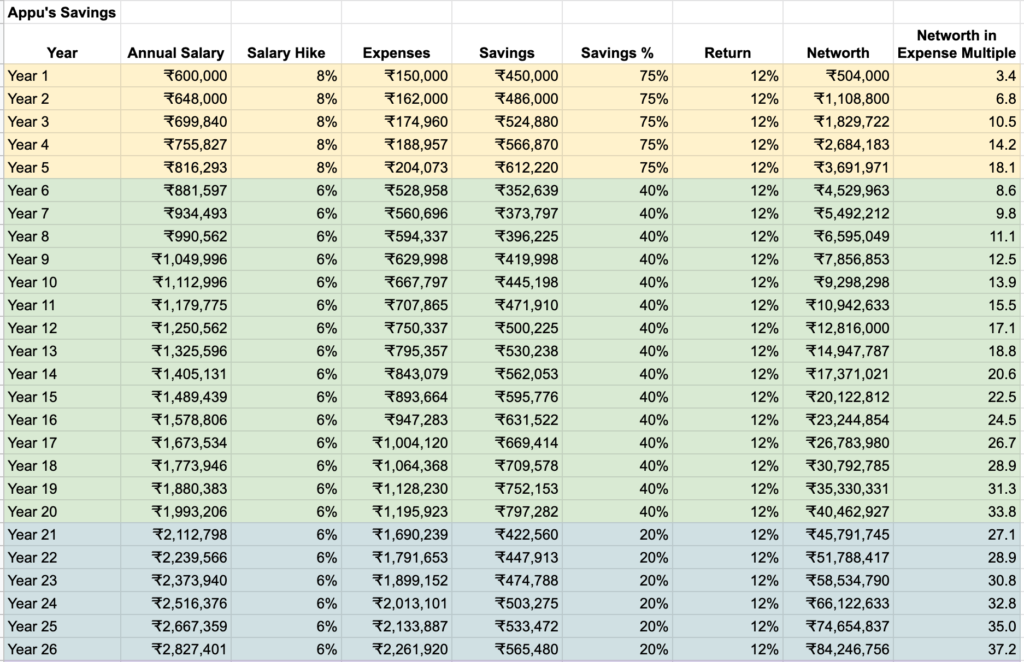

In our example, Appu’s 37 Lakh nest egg would have grown to 2.02 Cr in 15 years with no additional investment for 12% growth rate. But if Appu manages to save 40% during this phase, then by the end of year 20, he would have amassed 4.04 Cr – assuming a 6% increase in salary every year.

Phase 3 – Independent

Next is “Independent Phase” as we are financially independent now. For all the self controlled life that we have lived so far, we get to enjoy the benefits in this phase.

Now that we are financially independent, we are not tied by money any more. We do not have to compromise on things that we would have previously. This financial independence will give us the confidence to speak bold and to say and do the right things in the office. That empowerment will actually lead us to more responsibilities resulting in significant growth in career.

Now that we have a solid nest egg built by this time, we do not really have a need for savings. We have the freedom to spend all our earnings for luxury. The luxury car that we have been eyeing for a long time – now is the time to get it.

A bigger home? Sure. An international trip in business class? why not. In this phase, luxury expenses like these will not hurt our wealth building. We will have the total freedom to enjoy the luxury in this phase. But we have to be careful with one thing. All our expenses should be coming from our earnings. We should not touch our nest egg.

For 12% growth, this nest egg would double in 6 years. That means, we would have 50 times our annual expenses that we had by the end of growth phase. If we have not made any life style changes since the end of growth phase, we will have 50 times our annual expenses by now. But if we have upgraded our lifestyle to be a luxury one, we would be at 25 to 35 times the current annual expenses.

In our example, Appu’s nest egg would have grown from 4.04 Cr to 8.08 Cr with no additional contribution. But if he saved 20% in this phase, by the end of year 26, he would have 8.42 Cr as net worth – assuming a 6% increase in salary every year and a 12% annual return.

Phase 4 – Abundant

In this phase, it is not necessary for us to work to enjoy the luxury. Our investments will earn enough that we do not have to work for money to maintain our current life style. We will be making money doing nothing.

That does not mean sit idle at home. That would ruin both our physical and mental health. All this hard earned wealth will be for nothing then. We have to be both physically and mentally active at any age.

If we have built the wealth with this kind of dedication and focus, we will not be sitting idle after retirement. We will automatically start thinking about what we can offer for our community and we will start working on that. If you ask me, having an option to do something like that is what I call “Pure Luxury”.

So finally, if we look at how long it took us to build the wealth to support a comfortable life, it is just 26 years. If we have started this when we were 25 yrs old, we would have reached abundant phase by 51.

All this sounds good to hear – is this possible to execute it practically? I was able to do this by 42. But I was very aggressive with our savings and investments. You have to decide whether it would work out for you or not.

And one more thing. Appu’s example is to show the possibility. Not meant for mimicking exactly, as everyone’s situation is different with different salary, hike rate, savings %, risk profile etc. Knowing this possibility, come up with your own plan that fits your life style.

Good Luck!

If you find this post useful, please share it with your friends and family. Thank You.

Building Wealth Part 4: Long Term Thinking

Power of Compounding

When it comes to investment, the first concept that we need to understand is the Power of Compounding. Many quote that Einstein himself has said “Compounding is the eighth wonder of the world”. Regardless of whether he has actually said that or not, it is actually an amazing thing. Understanding that is the foundation of investing, over which we can build many creative wealth building strategies.

We have learned about Compound Interest in school. But whether we understood its full potential is questionable. It is very easy for us to think linearly. Let’s say that we earn 1 rupee or dollar every day. How much would we have earned by the end of 10 days? We can easily say that it is 10, as the calculation is linear. But let’s say that we have 1 rupee/dollar and it doubles every day. How much money would we have earned by the end of 10 days? The question might look simple, but this is not an easy question to answer unless we are a mathematic genius like Sakunthala Devi. Try it out and write down your guess on some paper.

Doubling it everyday looks like this:

2, 4, 8, 16, 32, 64, 128, 256, 512, 1024

How close were you with your guess? If you were pretty close, then you are probably an exponential thinker. Not many of us would have come close to the actual answer. There are three key lessons that we can learn from this number series.

Lesson #1:

Any investment that doubles 10 times becomes 1000 times the original investment. What does that imply? If I invest ₹1,000 in something today that can double every 5 years, then in 50 years, that ₹1,000 would have become ₹10 lakhs (₹1 Million) without any new additional investment.

Lesson #2:

The first double actually made just 1. But the 10th double made 512 to make the total 1024. What does this mean? Patience is the biggest asset for a successful investor. The longer we wait and let our investment compound, the bigger the benefit will be. The 11th double in this series will be 2048, a gain of 1024. And this is why saving as early as possible for our retirement is key to build a solid retirement portfolio, as it allows for more time for the money to compound.

Lesson #3:

It is the same effort to double 512 to 1024 as 1 to 2 – nothing different. However, only if we had saved the ₹1 in the first place, then we would have the option of making ₹1024 down the road. Thinking long term in our financial decisions is another key characteristic of a successful investor.

A Practical Example

Now let’s see how compounding works using a practical example.

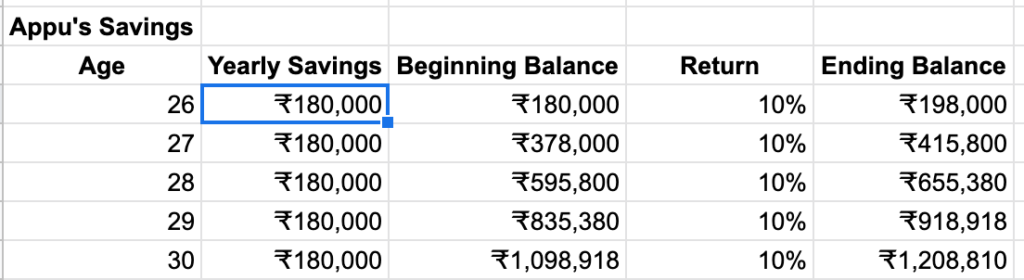

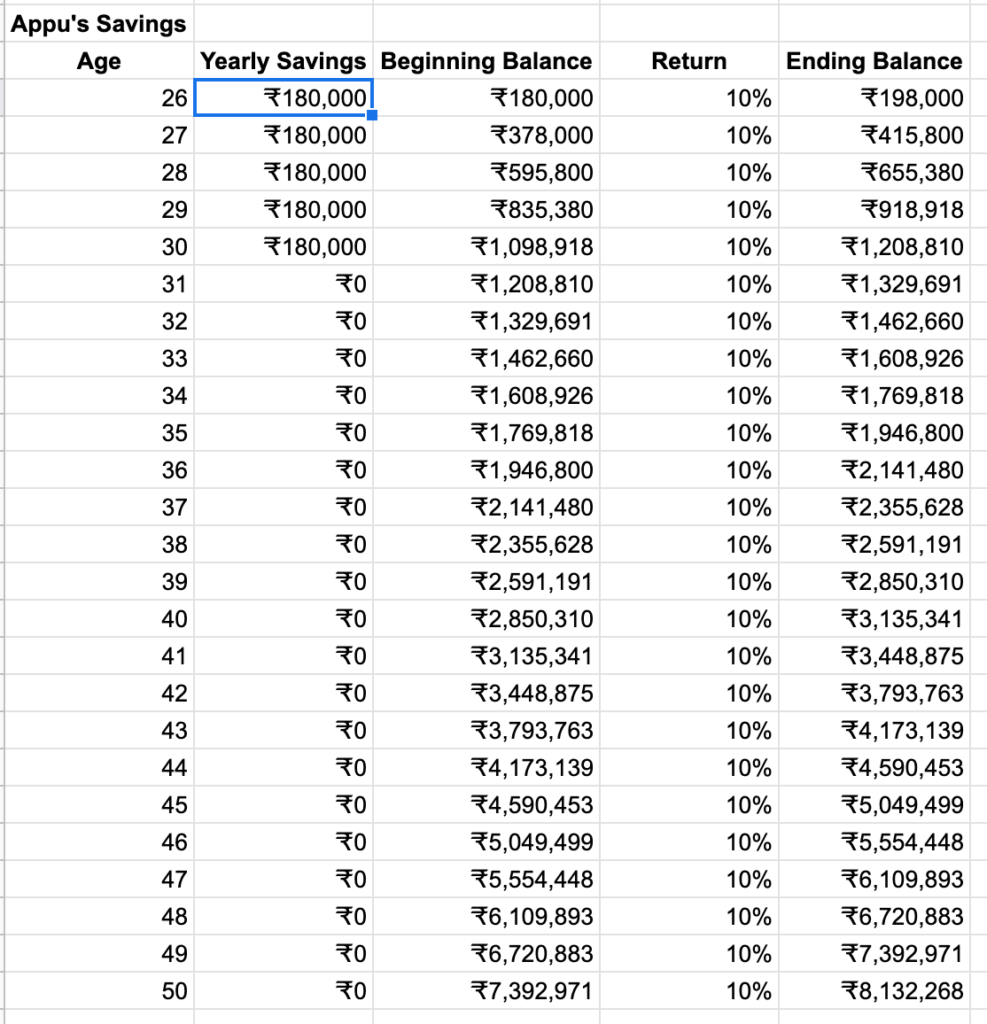

Appu is a 25 year old who has just joined his first job. His take home salary is ₹30,000 per month. He grew up knowing the power of compounding and is fully determined to take full advantage of it. So, he saves his income and invests 50% of his earnings in an index fund which is expected to give a 10% annual return. (i.e. he saves and invests ₹1,80,000 every year for a return of 10%). By the end of the next 5 years, he will have a net worth of ₹12 lakhs.

After he turns 30, he decides to get married and have kids. With this new expanded family, he is not able to save as aggressively as before. He ends up saving nothing after 30. But he lets his original investment compound. When he is 50, he will have a solid ₹81 Lakhs (₹8.1 Million) in his retirement portfolio. Just by saving aggressively when he was young, Appu was able to build his portfolio, even though he was not able to save a single paise after 30.

Note: For simplicity sake, we are assuming a steady return of 10% every year. But in real life, that return fluctuates every year.

There are three key parameters in the compounding calculation that has an influence on the final outcome.

1. Amount of savings

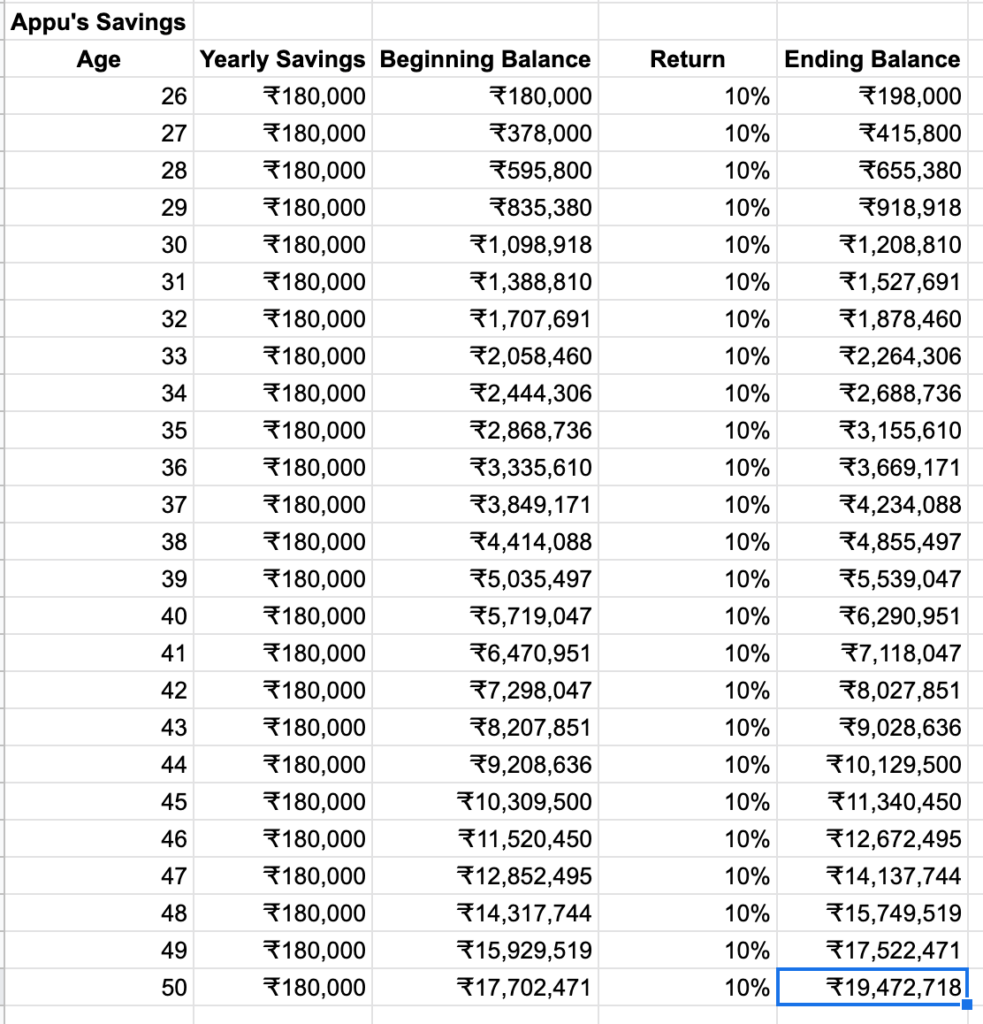

Depending on the amount of yearly savings, the final outcome will change drastically. In Appu’s example, even though his expenses go up with expanded family, his earnings would have grown as well, as he grows in his career. His spouse could be earning for the family as well. So, what if he was able to save ₹1,80,000 every year until he is 50? Now the final portfolio value when he is 50 jumps to more than double his previous amount, ₹81 lakhs, to ₹1.95 Crore (₹19.5 Million).

2. Return Rate

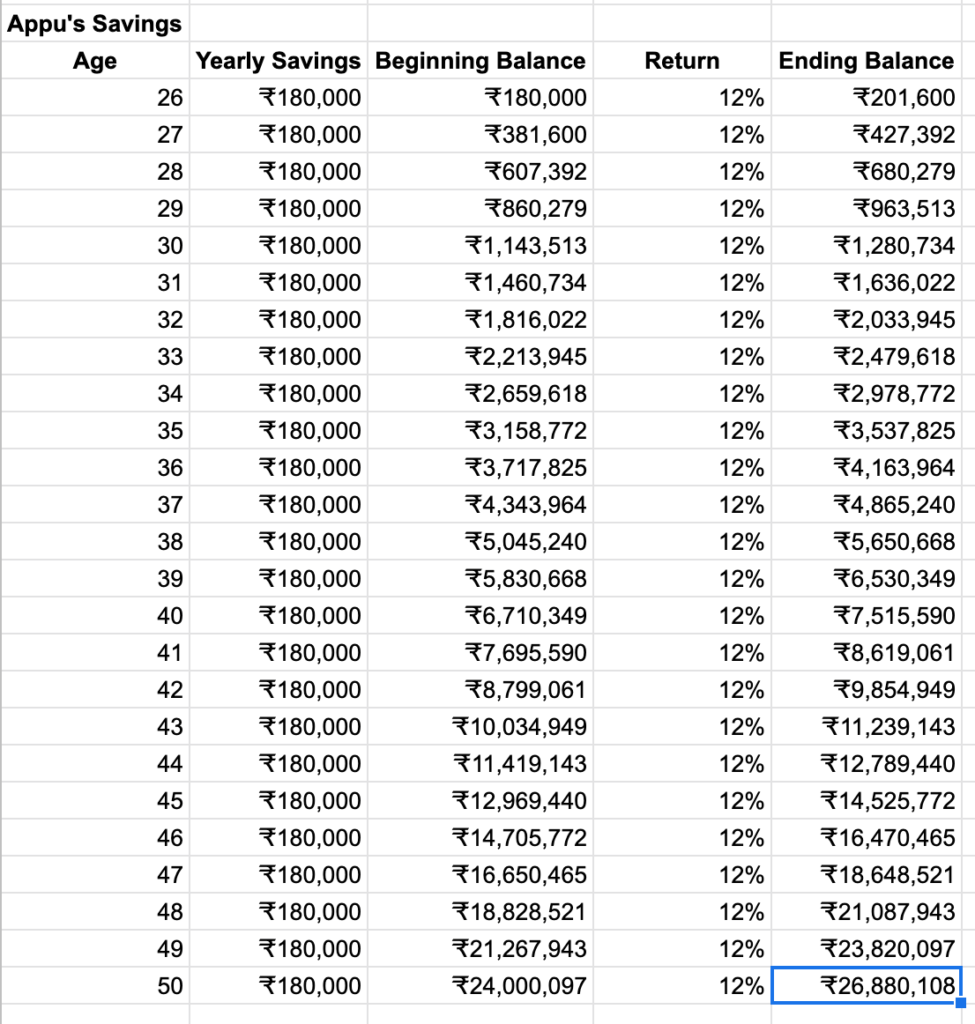

Return rate has a big impact on the final outcome as well. If Appu’s investment turn out to grow at 12% instead of 10%, then he would have ended up with ₹2.69 Crores (₹26.9 Million) instead of 1.95 Crores. This is why it is important to choose our assets wisely for our investments.

3. Invested Period

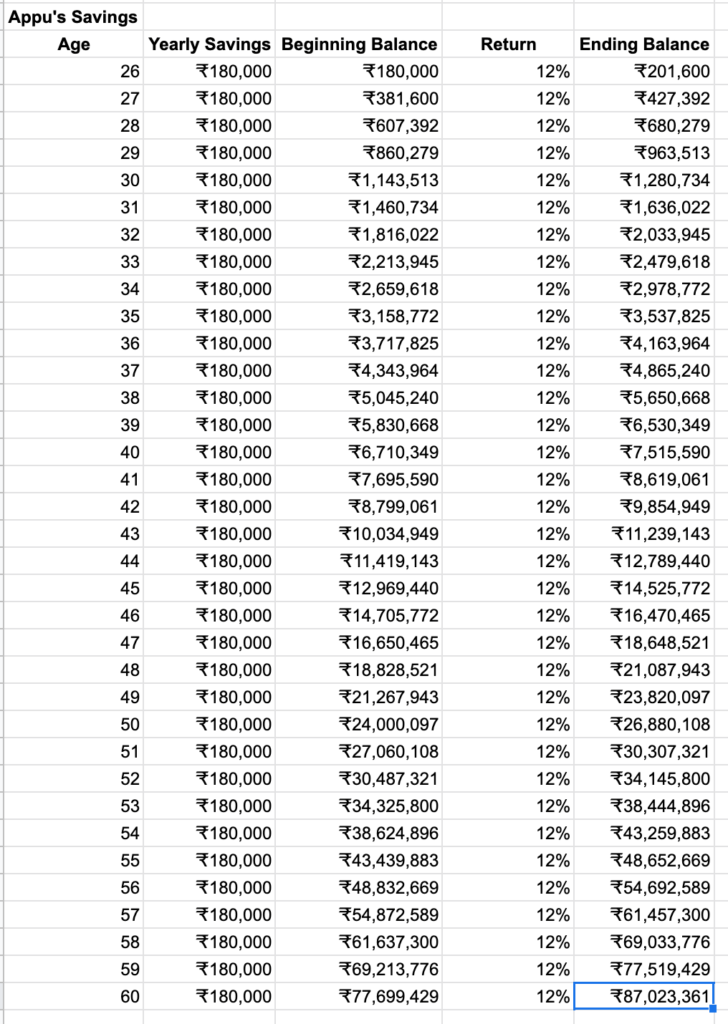

As we already saw, the amount of time the money is invested has a huge impact on the final outcome as well. If Appu decides to work until he is 60 instead of retiring at 50, then his final portfolio value would have been ₹8.7 Crores (₹87 Million) instead of 2.69 Crores.

I hope this post helped you to understand the Power of Compounding. So, think twice before you splurge your money on that latest iPhone or a fancy motor bike.

Check out this wonderful article in “Get Rich Slowly” that digs deeper into the power of compounding with wonderful illustrations.

You can use this quick online calculator to calculate your compounded growth.

If you like this post, please share it with your friends and family using the following social media links. Thank You!