When choosing a health insurance plan for your family, did you run into fancy terms, that did not actually make any sense to you? You have come to the right place. This episode will help you, to understand those terms better. We will also take a closer look at, how we can compare, the cost of different health insurance plans in this episode.

Premium

Let’s start with Premium. How much money, do you pay for your family’s health insurance? That amount, is the premium. You might pay, monthly or biweekly thru your paychecks. Many don’t even realize, how much money they are paying for their health insurance. Check your pay stub, and identify, how much you are paying per paycheck. Do the math for the whole year. Knowing the total annual amount you are paying for health insurance, will be helpful, in choosing the right insurance for your family.

Deductible

A deductible is a fixed amount, that you must pay, before your insurance starts paying for your medical expenses. For example, if you have a $1,000 deductible, you will be responsible for paying the first $1,000 each year, before your insurance kicks in. Up until you meet your deductible limit, insurance won’t pay a single penny for your medical expenses. This is something that you should remember, and be prepared, to pay out of your pocket every year.

So if a plan has a higher deductible, the cost of the insurance should be cheaper, right? That means, you will pay a, lower premium for it. So high deductible, low premium. Low deductible, high premium. So when you choose a health insurance plan, you should not just compare the premiums that you pay for them. You should also compare the deductibles. So from the cost perspective, a total of, the annual premium and the deductible across different plans, would be a fair comparison.

What happens after you meet your deductible? Would the insurance cover all the medical expenses for the rest of the year? Sadly, No. Here comes the next term.

Coinsurance

After you meet your deductible, your insurance will start covering, only a portion of the cost of your medical expenses. The rest is on you. It is called – Coinsurance.

If your insurance plan has a 80/20 coinsurance, it means, that your insurance company will pay for, 80% of the cost of your medical expenses, and you will be responsible for, paying the other 20%. Let’s see this thru an example.

Your deductible is $1,000. You have 80/20 coinsurance. So far this year, you have paid $1000 for your medical expenses, and you have already met your deductible limit. Now you are going to see a doctor, who charges you $500. As you have already met your deductible limit, you will pay only, 20% of that 500, which is $100. The rest $400, will be paid by the insurance.

This amount of coinsurance you pay, can vary, depending on your insurance plan, and the type of medical service you receive.

So it goes without saying, the lower the coinsurance, the higher the insurance premium. Something to remember, when choosing the right health insurance plan.

Copayment

Many confuse coinsurance with a copayment. They both are totally different. A copayment, also known as a copay, is a set amount of money, that you pay each time, you receive a specific medical service, such as a doctor’s visit or a prescription drug. This amount is typically a fixed dollar amount, and it is paid directly to the provider, at the time you receive the service. For example, if you have a $30 copay for doctor’s visits, you will be responsible for paying, $30, each time you visit the doctor, regardless of the cost of the visit.

Do copays count toward the deductible? unfortunately, No. The cost of each visit is, accounted differently from the copay. Only the cost of the visit is, counted towards your deductible. That means, if your doctor charged $300 for your visit, then that $300 will be accounted, towards your annual deductible. But the $30 you paid as copay, will not be counted in the deductible at all.

Out-of-pocket maximum

It is also known as, the out-of-pocket limit. This will be the maximum amount, you will be responsible for covered medical expenses, during a given policy period, which is typically a year. Once you reach this limit, your insurance company will cover, 100% of the cost, for the rest of the policy period. Again, typically a year.

Let’s say that your out-of-pocket maximum is, $3,000 per year. Then you will be responsible for, only paying up to a maximum of, $3,000 of your medical expenses each year. Once you reach this max limit, your insurance company will cover, all your medical expenses, for the rest of the policy period.

Remember that copay was not part of the deductible? But it will be counted, for the out of pocket max calculation. So anything that you pay as, copay, deductible, and coinsurance, will be counted towards the out of pocket maximum.

Let’s see this thru an example. Your deductible is $1,000. You have 80/20 coinsurance. and your maximum out of pocket is $3,000. During the coverage period, let’s say that you have incurred a total of, 20,000 dollars on medical expenses. Out of this 20,000, the first 1000 will be paid by you, because, that is your deductible amount. For the next 10,000, you will pay 2,000, and the insurance pays 8000 – because of 80/20 coinsurance. Now that you have met your maximum out of pocket of 3000 dollars, the rest of the 9000 will be covered, entirely by the insurance.

So a healthy family, rarely hits their out of pocket maximum in a year. But still, keep an eye on this. If you happen to hit the maximum limit in a year, you can potentially take advantage of that year for your other checkups, like your retina checkup or physiotherapy or whatever, which you might not do otherwise.

Another thing to remember here is, always have this out of pocket maximum money, readily available for any given year. If you are in a high deductible health plan, then HSA is the right place to have this money saved, and be ready for any emergency use. You would never know, when an emergency health crisis can come. It is better to be ready, to meet the out of pocket maximum.

So for comparing the cost of different health insurance plans, these are the most important numbers that you need to be aware of. Premium – how much you are going to pay to get the health coverage, Deductible – how much money you need to pay before your insurance kicks in, coinsurance – what % of the money that you need to pay for every medical service, copayment – how much money you need to pay for each doctor visit, and, the out of pocket maximum – the maximum amount that you could end up paying in a year.

Let’s take a look at an example comparison.

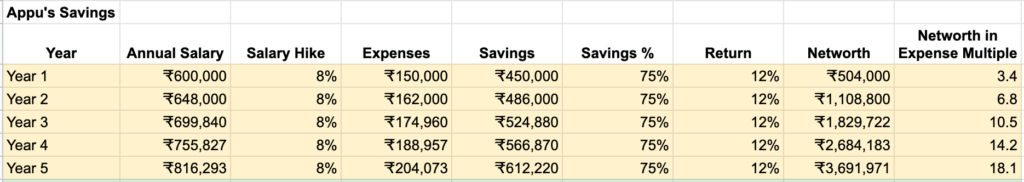

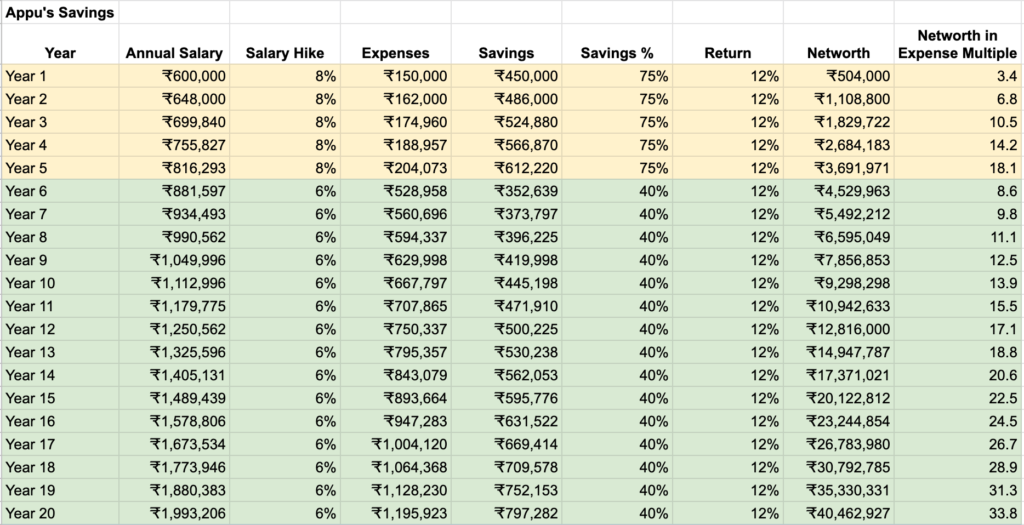

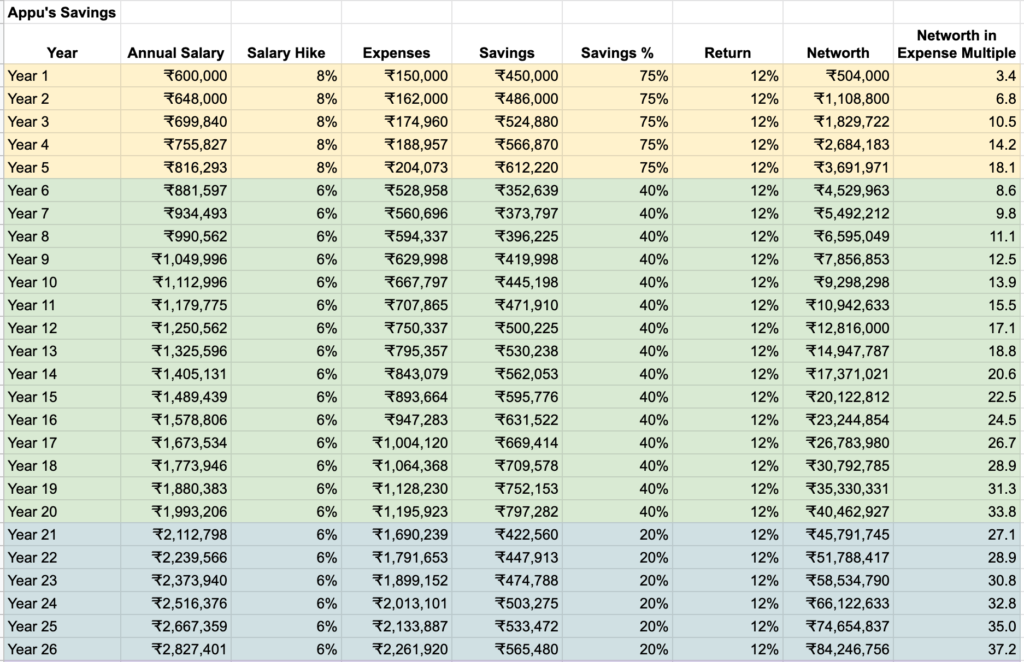

Two different plans. Plan A and Plan B. Both cover similar needs. But the cost is different. Plan A has a deductible of 3000 dollars, and an Out of pocket maximum of, 6000 dollars. Plan B has a deductible of 4500 dollars, and an out of pocket maximum of, 8000 dollars. The coinsurance is 20%, and the copayment is 30 dollars, for both plans.

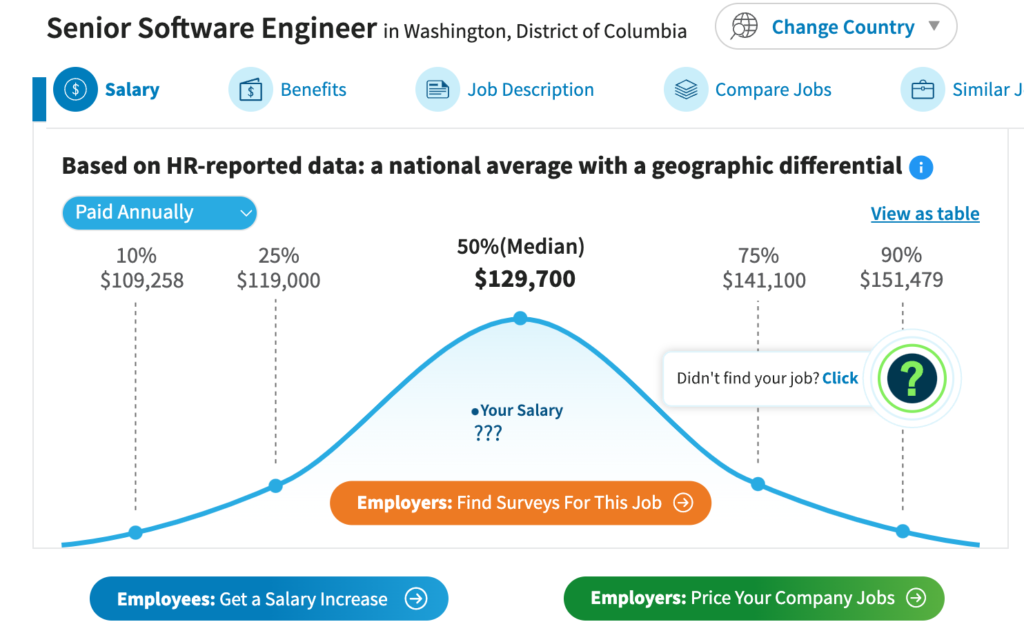

Just from these numbers, we can clearly see that, Plan A is better than Plan B. And so Plan A’s premium is, 5573 dollars, and Plan B’s premium is, 3743 dollars per year.

To compare these 2 plans, let’s run thru 3 different scenarios. Scenario 1. Your annual healthcare expenses are, 10,000 dollars per year on average. So you are expecting to have, the same 10,000 dollars this year as well. So for Plan A, you would have paid, $3000 for the deductible. $1400 for coinsurance, and let’s say, that you have 10 doctor visits that year. So a total of, 300 for copayment. Adding the premium 5573 you paid for the coverage, you would have a total health care cost of, 10,273 dollars for Plan A.

For Plan B, you would have paid 4500 as deductible, 1100 as coinsurance, and 300 for copayment. Adding the premium 3,743, you would have a total healthcare cost of, 9,643 dollars.

Plan A looked good on paper. But when we add the premium cost we pay for the insurance, Plan B looks better now.

What if your total health expenses are, 20,000 dollars? Plan A total cost comes out to be, 11,573, and Plan B, 11,743. Plan A is coming out, a little bit better in this scenario.

What if your total health expenses are, just 5,000 dollars? Plan A is 9,273 and Plan B is 8,643. Plan B comes out ahead, for this scenario.

So run your numbers thru different plans, and decide on the plan, that makes more sense for your scenario. One thing to note here is, we are assuming that all the other benefits, like emergency visit, urgent care, they are all same for both plans.

In general, if you are a healthy family, that does not visit the doctor office often, a high deductible plan, with a low premium, makes more sense for you.

That is all folks. Hope this is helpful. See you all soon in another episode. Thank you.