Is Roth 401K better than a Pretax 401K? Explained in detail with sample calculation.

SECURE 2.0 (Changes to 401K, IRA and 529)

Secure Act 2.0 was signed by President Biden this year. It comes with a lot of changes. Most of them are trivial, that should not affect our tax or retirement planning. But, some of them are, important enough, that we should be aware of them. We will cover them in this episode.

Why HSA is Better than 401K?

HSA is a health savings account. Don’t get fooled by the name. It can go, beyond health savings. Not many know, that HSA is the best tax-advantaged account in the USA. Even better than a 401K. How is it better? We will take a closer look at it in this episode.

HSA Contribution

You can contribute to HSA, only if you meet two conditions. The first condition is, just like a 401K, HSA has to be offered by your employer. The second condition is, you should be on an HDHP, High Deductible Health Plan. If you choose to have a PPO plan, then you will not be able to contribute to HSA. A high Deductible health plan, is a requirement for you to contribute to HSA.

How much can you contribute? For 2023, you can contribute up to, $3,850 just for yourself. But if you have your whole family under your coverage, then you can contribute up to, $7,750. So the maximum a family can contribute to their HSA is, $7750 per year.

Many assume, that the money contributed to HSA, needs to be used within that specific year. But it is not true. It is true only for, FSA. Not for HSA. For HSA, unused money gets rolled over into the next year. For example, if you contribute $7000 this year, and if you used only $2000 for your healthcare expenses, then the remaining $5000 will be, rolled over into next year. Just like your savings account. It is called a Health Savings account for a reason, right?

Though it is like a savings account, it does have a neat, twist to it. You have the option of, investing your savings in mutual funds, just like in a 401K. But every plan has a certain minimum amount, that you need to maintain in your cash account, before you can invest in a mutual fund. Mostly it is $1000. So you can set up your account in a way, so that any new contribution that goes over your cash limit, gets automatically invested in a mutual fund.

“But Vijay, I can do all these in a brokerage account. What is so special about HSA?” Tax advantage. Not just one. Triple tax advantage. You do not have to pay tax on the contributed money, No tax for any gains from the investments, and as long as it is used for a qualified medical expense, No tax for withdrawal as well. So there are 3 tax advantages for an HSA. No other plan in the US, has this unique triple tax advantage.

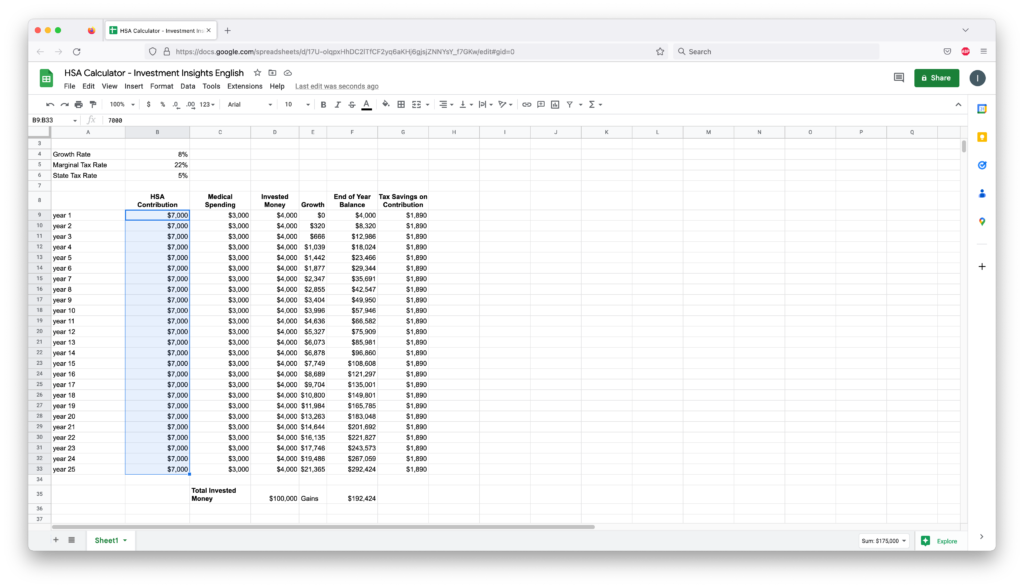

For example, let’s say that you contribute $7,000 every year to your HSA. But you use only, $3000 every year for your medical expenses. And so the rest of the contribution $4000, is invested and it is growing at a rate of, say 8%. If you are in the 22% marginal tax bracket, and if your state tax is 5%, then you will be saving, $1890 per year on taxes. This is the first tax advantage.

Let’s say that you continue to do this, until your retirement in 25 years. By the end of the 25th year, you will have an HSA balance of, $292,000. Of which, $100,000 is your total contributed money, and $192,000 is capital gains. Now, there is no tax for this gain of, $192,000 as well. This is, the second tax advantage.

Both the first and the second tax advantage, 401K has them as well. No tax for contributions, and no tax for capital gains. But where HSA gets better than 401K is, the third tax advantage. If used for qualified medical expenses, then there is no tax for HSA withdrawal. But in a 401K, when you withdraw the money after retirement, the withdrawal amount will be considered as your income for that year, and you will pay tax for that income. This is why, an HSA is better than a 401K.

Non-Medical Expenses

But what if you withdraw from an HSA, for non-medical expenses? Then those withdrawals will be considered ordinary income, and you have to pay tax on those withdrawals. Just like in a 401K. So essentially, at best, HSA has a triple tax advantage, better than a 401K. At worst, it is like a regular 401K.

This is assuming that you are withdrawing after your retirement age of 65. But if you withdraw for non-qualified expenses, before you turn 65, then you have to pay the tax, and also a penalty of 20%. So it is not a good idea to withdraw from HSA, before retirement for non-qualified expenses. Qualified medical expenses can be withdrawn at any time, with no tax or penalty.

Leaving the company?

But what if you leave the company? If you leave the company, you have 2 options. Leave the HSA account as it is with your old employer. But the problem is, you have another additional account to manage. Also, there will be extra fees for the account maintenance. A better option is, to move the HSA balance into your own HSA account. Yes, you can open your own HSA account. Just that you cannot contribute directly to it. But you can roll over your HSA balance, from an existing HSA account. Fidelity has a good HSA plan with no fees.

Now let’s look at the qualified medical expenses. You can use your HSA, to pay for your deductible, coinsurance, and copay. For example, you have a health insurance plan, with $3000 deductible, 20% coinsurance, and a $50 copayment. For every doctor visit, you will be paying, $50 copayment. This can be paid thru your HSA. And you will be paying 100% of your healthcare expenses, until you reach your deductible limit of, $3000. That whole $3000 can be paid using HSA. After you meet your deductible limit, you have to pay, 20% of all the healthcare expenses – because you have a coinsurance of, 20%. That can be paid using HSA as well. In short, for any medical expenses that you are paying from your own pocket, you should be able to pay with your HSA. Even if you are in, another country.

How about health insurance premiums? Yes, we can pay certain healthcare premiums, but not all. By default, HSA cannot be used for health insurance premiums. But there are a few exceptions to that rule. If you lose your job, and if you decide to continue your employer’s healthcare under COBRA, then you can use HSA, to pay for the COBRA plan premium. Another exception is, if you are getting unemployment compensation, then paying a healthcare premium during that period, can be covered by HSA. These 2 exceptions are applicable during your working years.

But after 65, you can use HSA to pay, certain medicare insurance premiums. There are 4 different medicare insurance – Part A, for inpatient hospitals, Part B for Doctor visits, Part C – a combination of Part A and Part B, with some additional benefits, and then Part D, for prescription drugs. Among these, Part B and Part D premiums, can be paid thru HSA. Other than the medicare premiums, long-term care premiums can be paid using HSA as well, though it has limits depending on your age.

You can check the HSA bank site, to see the list of qualified medical expenses for HSA.

Knowing these characteristics of HSA, are there any ways to maximize these HSA benefits? Yes, there are. There are a few strategies that people follow. They max out their HSA contribution every year – contributing $7750 to their HSA. Let’s say that their insurance plan, requires an out-of-pocket maximum of, $8000. That means, the maximum they have to pay for healthcare expenses in a year is, $8000. Most of them, do not spend all the contribution. And so, by the end of the year, they have a size-able balance in their HSA. They start building their HSA balance, until it reaches $8000. Let’s say that it happens in 2 years. Starting from 3rd year, they will always keep this $8000, in their HSA cash account for emergency needs, and start investing the additional contribution, in equity mutual funds. This will help them, to build a nice balance in their HSA, by the age of 65.

There are certain folks, who take this strategy to the extreme. Knowing that healthcare expenses will be a lot more expensive after 65, they will not pay any healthcare expenses with their HSA now. They will just contribute to their HSA, and start building the HSA balance. Though they do not use HSA to pay healthcare bills, they save all their healthcare receipts. Because, those receipts can be used to withdraw HSA funds, anytime in the future. The idea here is, to give maximum time, to all the HSA contribution money to grow. By not withdrawing now, the balance grows tax-free for future healthcare expenses.

After retirement, a married couple would spend, close to $300,000 on average, for their healthcare. Now you can see, why certain folks are, building up their HSA balance for the future.

I hope this episode helped you to understand HSA better. Please share it with your friends and family, who can get benefit from this. Especially younger folks, who have just started earning. See you all soon in another episode. Thank you.

How to create a good Financial Plan

If you have no idea about financial planning and don’t know where to start, then you are at the right place. Following these 5 steps can help to build a good financial plan for your future.

Given the priorities in our life at different stages, most of us do not even get time to think about financial planning until our mid life. But if we are aware of the importance of having a financial plan at young age, we will definitely be in an advantageous position.

Step #1: Buy a Life Insurance

When it comes to financial planning, the first thing to do is, buying a life insurance.

Many I know, who is the sole bread winner for the family, do not have life insurance at all. They know that their whole family is dependent on their income. But still, they have not found the motivation to buy a life insurance for them yet.

Up until a tragedy strikes, we will not realize the seriousness of it. Few years ago, a family of dad, mom and a 6 year old son was living in the same apartment complex as me. The dad was just fine, but one day fell unconscious while shopping in Walmart. But he passed away on the way to the hospital in the ambulance.

His family was in total shock. Bigger shock is that he did not have any life insurance. It is just not the emotional stress of his loss for his family, but now they have to face the financial stress for the rest of their life as well.

We are seeing many incidents like this. At least one gofundme request coming in our whatsApp groups and facebook posts every week. But how long can a family survive with those funds?

Do not see life insurance as optional. It is a must. If loss of a family member will bring financial stress to the family, then that family member should definitely have a life insurance.

When it comes to life insurance, we should not be buying insurance products mixed with investments, like universal plan, endowment plan and ULIPs. We should be buying simple and straight forward Term Insurance. It is very cheap too.

Buying a term insurance is not complicated at all as we think. For more information on how to buy a term insurance, watch this episode. If you are in US, White Coat investor’s guide for buying term insurance is an excellent resource.

We should be buying Term insurance for a coverage of at least 25 times our annual expenses and for a term (period) till we retire. Do not skip buying life insurance just because you are already covered in your office. Their coverage can serve for only few years, which will not be enough for the family for their life time.

So when it comes to financial planning, regardless of whether you are doing other things or not, definitely buy life insurance.

Step #2: Pay Off Debt

Next thing to handle is “Debt”. While a debt could slow down the growth for some, it could totally destroy others.

Watch this episode to understand the difference between a good debt and a bad debt and also to learn some tricks to pay off debts faster.

It is not smart to invest for 8% return when we have a debt that sucks up 10% interest. That is why it is important to pay off our bad debts before proceeding to the next step in financial planning.

Step #3: Build an Emergency Fund

Our life never goes smooth as we expect. It always throws in few surprises and shocks here and there. An emergency fund will give us the safety cushion to handle those surprises.

At least have 6 months of expenses as emergency funds. Many think that they can handle all their emergency needs with their credit card. Bad idea. All the hard work we did in step 2 to get rid of the monkey “debt” will go waste. The debt monkey will be on our back again if we use the credit card for emergency.

I don’t know about you. But I would not like to carry around a monkey on my back. I will try my best to keep it as far as possible. Emergency fund will help with that.

Many ask the question of where to invest the emergency fund. Emergency fund is meant for handling emergency, not for investments. So always have the emergency funds in an easily accessible liquid accounts like in a savings account.

If you have completed the first 3 steps – buying a life insurance, paying off all bad debts and also have an emergency fund, then you can pat yourself on your back. Just doing these three will put you ahead of most in financial planning.

Step #4: Saving for Retirement

Most of us do not even think about saving for retirement until we hit 40. But by that time half of our life is gone.

As we saw in “Power of Compounding”, the sooner we save and invest for our retirement, the better the final growth amount will be. So do not take retirement planning for granted until it is too late.

Also remember the impact of inflation. Inflation rate in India is around 5% on average. That means, if our monthly expense is ₹50,000 now, then in 10 years, we would need ₹82,000 to maintain the same life style. In 20 years, the same need will become ₹1,33,000.

We should know how much to save Today and which assets to invest those savings so that we can generate an income of ₹1,33,000 per month after retirement. Saving just in a Fixed Deposit is not going to cut it.

We should learn to take calculated risks and invest in assets that has potential to beat the inflation. Watch this “Asset Allocation” episode to understand the risks and return potential of different assets in the market.

Having equity exposure is key to have enough money on our retirement. General rule for retirement savings is, invest your age % in assets like bonds (debt instruments) and (100 – your age) % in equity (stocks). If I am 40, I should have 60% of my portfolio in equity and 40% in other assets. Adjust those percentages to fit your comfort.

US residents can watch these 401K and IRA episodes to understand more about the retirement plans available in US.

If you need help building an equity portfolio, read this post.

Step #5: Saving for Children Education

Next in our priority list is saving for children education.

For all those emotional parents who give higher priority to saving for children education than to saving for their retirement, remember, there is always loan available for education, but not for retirement. We should not forget that fact.

Education cost inflation is about 8%, both in India and in USA. For our calculation purpose, it is better to assume the college fees to rise at a rate of 10% every year. A 5 lakhs cost Today would become 13 Lakhs in 10 years and 34 lakhs in 20 years.

Some of the YouTube episodes on this topic:

- Calculating Children Education needs and Investment options

- College Expenses in USA

- 529 Plan Explained (USA)

These are 5 critical steps in basic financial planning. We can take it to the next level by buying proper health insurance, writing will etc. We will cover those topics some other time.

Professional Financial Planners:

If you think that this basic financial planning itself is too complicated, then you definitely need a professional financial planner’s help. Don’t go to your bank’s regional manager or financial advisor. They will try to hit their sales target by selling products you do not need. To be fair, it is not their mistake. They are doing their job.

Look for fee only financial planners like here, who do not earn any commission from selling products. If you are in US looking for professional financial planning guidance, Mari from Samatva Wealth Management can help you.

Hope this is helpful. Don’t hesitate to share this with your friends and family. Thank You!