Is Roth 401K better than a Pretax 401K? Explained in detail with sample calculation.

SECURE 2.0 (Changes to 401K, IRA and 529)

Secure Act 2.0 was signed by President Biden this year. It comes with a lot of changes. Most of them are trivial, that should not affect our tax or retirement planning. But, some of them are, important enough, that we should be aware of them. We will cover them in this episode.

Marginal Tax Vs Effective Tax Rate

Do you know the difference between, a marginal tax rate, and an effective tax rate. It is very important, that we understand the difference. It will be of huge help, with our tax planning.

What is Marginal Tax rate?

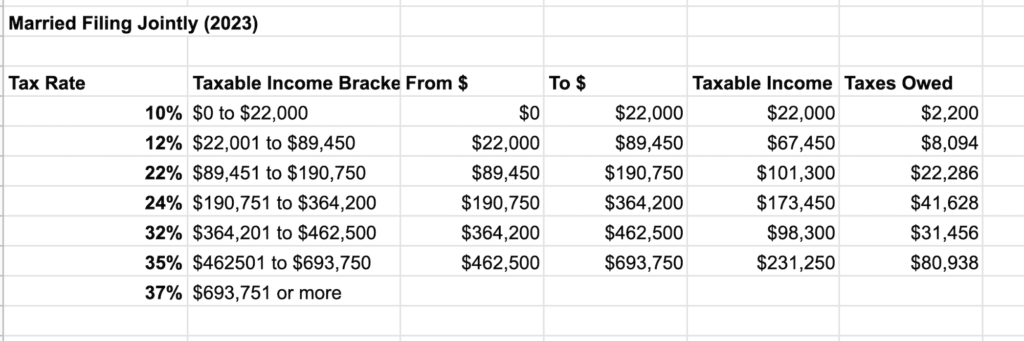

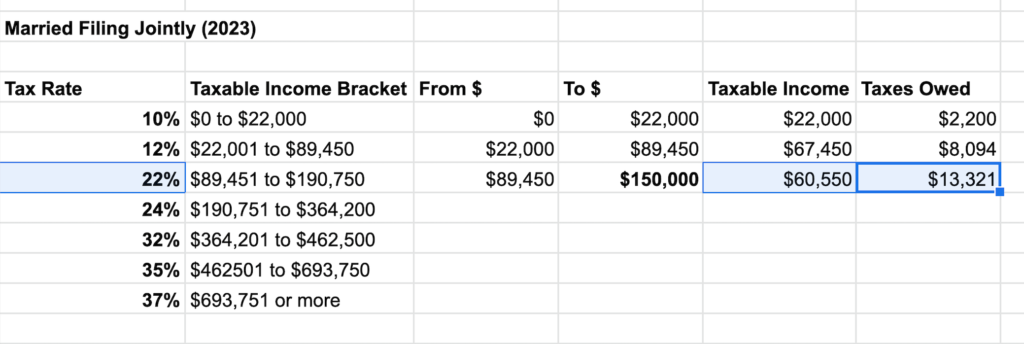

To understand that, we should know, how our income is taxed. What we are seeing here is, US tax brackets for 2023. Though I am showing US example here, the concept is essentially same for India as well.

Let’s say that your family’s total income is, $150,000 dollars for the year. The whole 150,000, will not be taxed at the same rate. There are different tax rates, for different brackets of the income.

For married, Filing jointly – the first 22,000 of the family income, will be taxed at 10%. So that would be, 2200. From 22,001 to 89,450, it will be taxed at 12%. Note, how the 12% tax rate is applicable, only for any income over 22,000, and not for the whole 89,450. This is an important difference that we should remember.

The next tax bracket is 22%, which is applicable only for, any income over 89,450, but less than 190,750. And we can see, as the family income increases, and crosses a tax bracket, the additional incremental income is, taxed at a higher tax rate.

So for our example of 150,000 family income, the first 22,000 will be taxed at 10%, the next 67,449 will be taxed at 12%, and the rest 60,549, will be taxed at 22%.

The tax rate of your top most dollar, that is the tax rate of the last dollar you earned in that year, is, your marginal tax rate. So in this example, the top most dollar is taxed at, 22%. So your marginal tax rate is, 22%.

The total taxes owed for this example is, 23,615 dollars. That will be, 15.74% of total income 150,000. So you will be effectively paying, 15.74% tax rate. This is Effective tax rate.

So for 150,000 dollars family income, the marginal tax rate is 22%, and the effective tax rate is, 15.74%.

Why is this marginal tax rate important? Whenever you contribute money to any tax advantaged account, like a 401K, IRA or HSA, you are saving at marginal tax rate, because you are contributing the money from your, top most tax bracket.

For example, for your family income of 150,000, if you maximize your 401K, by contributing 22,500 dollars, then you are saving, 22% of that contribution on taxes. which is, 4950 dollars.

If you are in a higher marginal tax bracket, your tax savings is even more. Say that your family income is 400,000 dollars. Then your 401K contribution of 22,500, will save you 32% on taxes, which is, 7200 dollars.

Hope this helps to understand, how much money you save on taxes, when you contribute to a tax advantaged account.

Why HSA is Better than 401K?

HSA is a health savings account. Don’t get fooled by the name. It can go, beyond health savings. Not many know, that HSA is the best tax-advantaged account in the USA. Even better than a 401K. How is it better? We will take a closer look at it in this episode.

HSA Contribution

You can contribute to HSA, only if you meet two conditions. The first condition is, just like a 401K, HSA has to be offered by your employer. The second condition is, you should be on an HDHP, High Deductible Health Plan. If you choose to have a PPO plan, then you will not be able to contribute to HSA. A high Deductible health plan, is a requirement for you to contribute to HSA.

How much can you contribute? For 2023, you can contribute up to, $3,850 just for yourself. But if you have your whole family under your coverage, then you can contribute up to, $7,750. So the maximum a family can contribute to their HSA is, $7750 per year.

Many assume, that the money contributed to HSA, needs to be used within that specific year. But it is not true. It is true only for, FSA. Not for HSA. For HSA, unused money gets rolled over into the next year. For example, if you contribute $7000 this year, and if you used only $2000 for your healthcare expenses, then the remaining $5000 will be, rolled over into next year. Just like your savings account. It is called a Health Savings account for a reason, right?

Though it is like a savings account, it does have a neat, twist to it. You have the option of, investing your savings in mutual funds, just like in a 401K. But every plan has a certain minimum amount, that you need to maintain in your cash account, before you can invest in a mutual fund. Mostly it is $1000. So you can set up your account in a way, so that any new contribution that goes over your cash limit, gets automatically invested in a mutual fund.

“But Vijay, I can do all these in a brokerage account. What is so special about HSA?” Tax advantage. Not just one. Triple tax advantage. You do not have to pay tax on the contributed money, No tax for any gains from the investments, and as long as it is used for a qualified medical expense, No tax for withdrawal as well. So there are 3 tax advantages for an HSA. No other plan in the US, has this unique triple tax advantage.

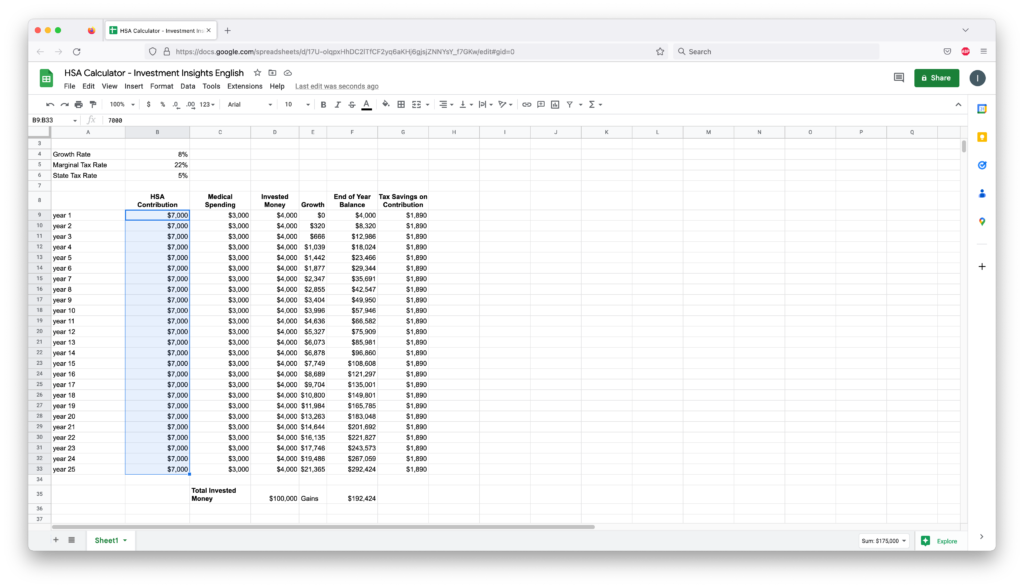

For example, let’s say that you contribute $7,000 every year to your HSA. But you use only, $3000 every year for your medical expenses. And so the rest of the contribution $4000, is invested and it is growing at a rate of, say 8%. If you are in the 22% marginal tax bracket, and if your state tax is 5%, then you will be saving, $1890 per year on taxes. This is the first tax advantage.

Let’s say that you continue to do this, until your retirement in 25 years. By the end of the 25th year, you will have an HSA balance of, $292,000. Of which, $100,000 is your total contributed money, and $192,000 is capital gains. Now, there is no tax for this gain of, $192,000 as well. This is, the second tax advantage.

Both the first and the second tax advantage, 401K has them as well. No tax for contributions, and no tax for capital gains. But where HSA gets better than 401K is, the third tax advantage. If used for qualified medical expenses, then there is no tax for HSA withdrawal. But in a 401K, when you withdraw the money after retirement, the withdrawal amount will be considered as your income for that year, and you will pay tax for that income. This is why, an HSA is better than a 401K.

Non-Medical Expenses

But what if you withdraw from an HSA, for non-medical expenses? Then those withdrawals will be considered ordinary income, and you have to pay tax on those withdrawals. Just like in a 401K. So essentially, at best, HSA has a triple tax advantage, better than a 401K. At worst, it is like a regular 401K.

This is assuming that you are withdrawing after your retirement age of 65. But if you withdraw for non-qualified expenses, before you turn 65, then you have to pay the tax, and also a penalty of 20%. So it is not a good idea to withdraw from HSA, before retirement for non-qualified expenses. Qualified medical expenses can be withdrawn at any time, with no tax or penalty.

Leaving the company?

But what if you leave the company? If you leave the company, you have 2 options. Leave the HSA account as it is with your old employer. But the problem is, you have another additional account to manage. Also, there will be extra fees for the account maintenance. A better option is, to move the HSA balance into your own HSA account. Yes, you can open your own HSA account. Just that you cannot contribute directly to it. But you can roll over your HSA balance, from an existing HSA account. Fidelity has a good HSA plan with no fees.

Now let’s look at the qualified medical expenses. You can use your HSA, to pay for your deductible, coinsurance, and copay. For example, you have a health insurance plan, with $3000 deductible, 20% coinsurance, and a $50 copayment. For every doctor visit, you will be paying, $50 copayment. This can be paid thru your HSA. And you will be paying 100% of your healthcare expenses, until you reach your deductible limit of, $3000. That whole $3000 can be paid using HSA. After you meet your deductible limit, you have to pay, 20% of all the healthcare expenses – because you have a coinsurance of, 20%. That can be paid using HSA as well. In short, for any medical expenses that you are paying from your own pocket, you should be able to pay with your HSA. Even if you are in, another country.

How about health insurance premiums? Yes, we can pay certain healthcare premiums, but not all. By default, HSA cannot be used for health insurance premiums. But there are a few exceptions to that rule. If you lose your job, and if you decide to continue your employer’s healthcare under COBRA, then you can use HSA, to pay for the COBRA plan premium. Another exception is, if you are getting unemployment compensation, then paying a healthcare premium during that period, can be covered by HSA. These 2 exceptions are applicable during your working years.

But after 65, you can use HSA to pay, certain medicare insurance premiums. There are 4 different medicare insurance – Part A, for inpatient hospitals, Part B for Doctor visits, Part C – a combination of Part A and Part B, with some additional benefits, and then Part D, for prescription drugs. Among these, Part B and Part D premiums, can be paid thru HSA. Other than the medicare premiums, long-term care premiums can be paid using HSA as well, though it has limits depending on your age.

You can check the HSA bank site, to see the list of qualified medical expenses for HSA.

Knowing these characteristics of HSA, are there any ways to maximize these HSA benefits? Yes, there are. There are a few strategies that people follow. They max out their HSA contribution every year – contributing $7750 to their HSA. Let’s say that their insurance plan, requires an out-of-pocket maximum of, $8000. That means, the maximum they have to pay for healthcare expenses in a year is, $8000. Most of them, do not spend all the contribution. And so, by the end of the year, they have a size-able balance in their HSA. They start building their HSA balance, until it reaches $8000. Let’s say that it happens in 2 years. Starting from 3rd year, they will always keep this $8000, in their HSA cash account for emergency needs, and start investing the additional contribution, in equity mutual funds. This will help them, to build a nice balance in their HSA, by the age of 65.

There are certain folks, who take this strategy to the extreme. Knowing that healthcare expenses will be a lot more expensive after 65, they will not pay any healthcare expenses with their HSA now. They will just contribute to their HSA, and start building the HSA balance. Though they do not use HSA to pay healthcare bills, they save all their healthcare receipts. Because, those receipts can be used to withdraw HSA funds, anytime in the future. The idea here is, to give maximum time, to all the HSA contribution money to grow. By not withdrawing now, the balance grows tax-free for future healthcare expenses.

After retirement, a married couple would spend, close to $300,000 on average, for their healthcare. Now you can see, why certain folks are, building up their HSA balance for the future.

I hope this episode helped you to understand HSA better. Please share it with your friends and family, who can get benefit from this. Especially younger folks, who have just started earning. See you all soon in another episode. Thank you.

Tax Loss Harvesting

Now that we are approaching the end of the year 2022, you might be wondering, if there is anything that we can do in our portfolio, to save on our taxes. Especially, when S&P 500 has gone down by 17% and Nasdaq 100 by 30%. Yes, there are ways. It is called, Tax Loss Harvesting. But not everyone can take benefit from it. Why? We will take a closer look at it in this episode.

Use this episode as a general guide, to understand the capital gains tax in the US. Not as tax advice. Always check with your tax advisor for your tax planning.

Capital Gains Tax

We will start with, how capital gains are taxed in the US. A taxable event is triggered, only when you sell a security, like a stock or an ETF. Buying a security, or holding a security on gains – they are not accounted for tax purposes at all. But when you sell a security, you are going to realize a gain or a loss. And that is why, it is a taxable event.

When there is a gain, we have to pay tax on those capital gains. There are two types of capital gains. A long-term capital gain and a short-term capital gain.

If you sell a security, that you have held for more than a year, then the gains from that sale will be, a long-term capital gain. But if you held it for less than a year, then the gain will be, a short-term capital gain. The tax rates are different for both.

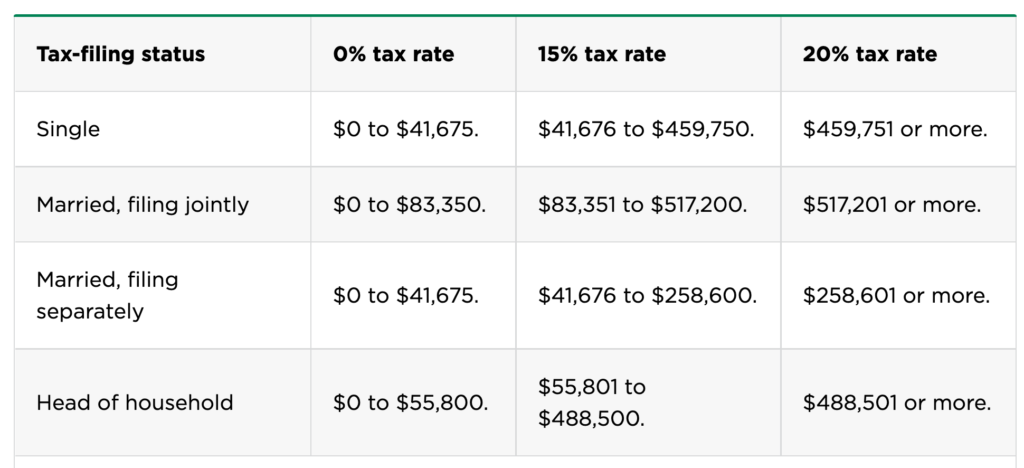

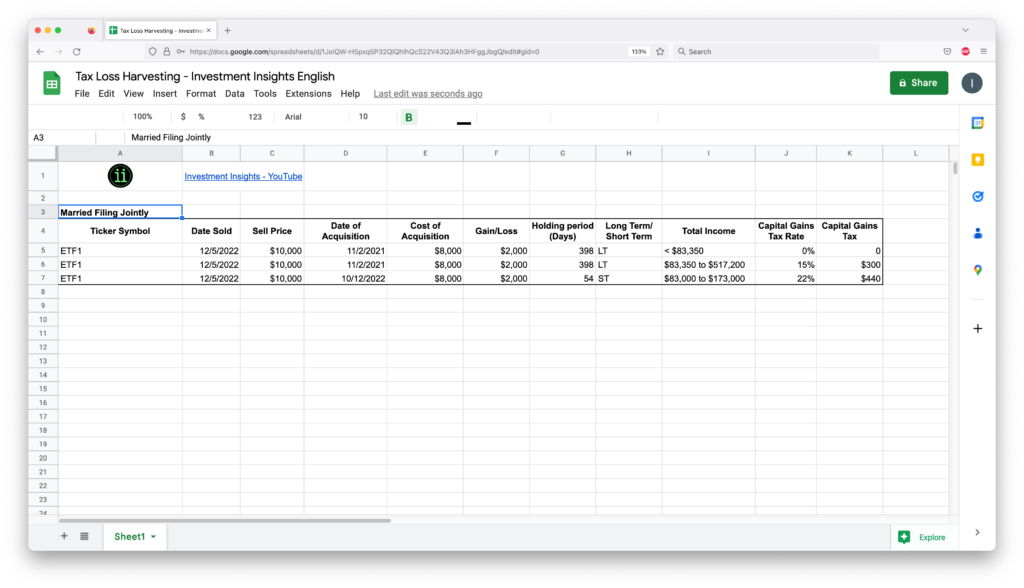

What we are seeing here is, tax rate chart for long-term capital gains. If you are married filing jointly, and if your total taxable income, including the capital gains, is less than 83,000 dollars, then your long-term capital gains tax rate is, 0%.

But if your total taxable income, including the capital gains, is more than 83,000, but less than 517,000, then your long-term capital gains tax rate is, 15%.

An example can help us to understand this better. Let’s say that you sold an ETF, for 10,000 dollars, on Dec 5th, 2022. You bought this ETF, for 8000 dollars, in Nov 2021. The gain 2000 dollars from this sale, would be a long-term capital gain, because you have held the ETF, for more than a year.

So now when you file the tax return for 2022, you need to report this gain 2000 dollars, as long-term capital gains. Now the tax rate for this gain 2000 dollars, depends on, your total taxable income – including this gain 2000 dollars.

So if your total taxable income, including this capital gain 2000 dollars, is less than 83,000, then you do not have to pay, any tax for this capital gain at all. This is assuming, that your tax filing status is, Married filing jointly.

But if your total taxable income is more than 83,000, but less than 517,000, then your capital gains tax rate is, 15%. That would be, 300 dollars tax on, 2000 dollars gain.

What if you held this ETF for less than a year? Let’s say that you bought this ETF in Oct 2022, for 8000 dollars. You sold this in December, for a gain of, 2000 dollars. Because you held this security for less than a year, you will be paying, short-term capital gains tax rate.

And the short-term capital gains tax rate is, your marginal income tax rate. That means, you will pay tax on the short-term capital gains, as if, you have earned that income from your full-time job.

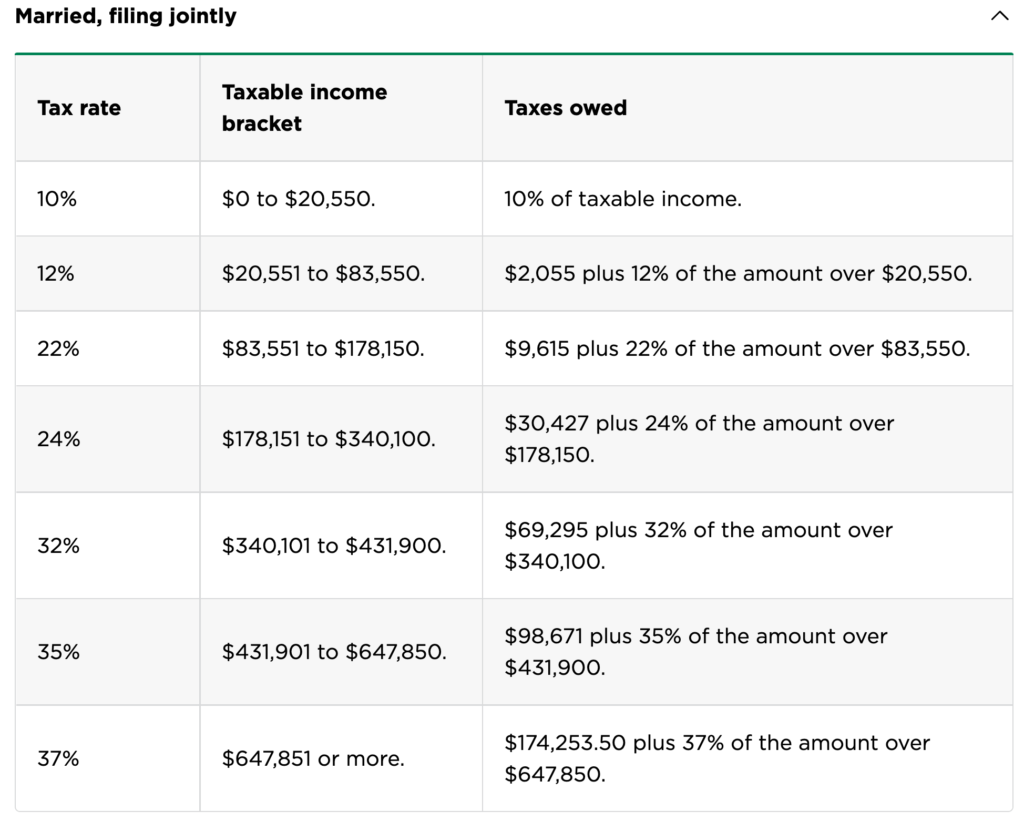

From https://www.nerdwallet.com/article/taxes/federal-income-tax-brackets

If your family income is between 83,000 and 173,000, then your marginal tax rate is, 22%. That means, you will be paying, 22% tax on any amount, that goes over 83,000 dollars in income. So in our example, the 2000 dollar short-term gain, will be added to your regular ordinary income, and will be taxed at 22%.

If your ordinary income is even higher, then you will end up paying, a higher tax rate for short term capital gains.

This is all good for gains. But what if there is a loss? How do we handle that?

Losses need to be handled in, 3 steps. First – deduct the loss from similar gains. Long-term loss should be deducted from, long-term gains. Short-term loss should be deducted from, short-term gains.

If there are still more losses, then those should be deducted from, any type of other gains. Meaning, a long-term loss can be deducted from a short-term gain, or a short-term loss can be deducted from, a long-term gain.

Finally, if there are still losses left, then up to 3,000 dollars, can be deducted from our regular ordinary income, and the rest, can be carried forward to the next year.

Again in the next year, the same steps are followed. If we do not have enough gains next year to offset the loses, then again, 3,000 can be deducted from our income, and the rest can be carried forward again. Losses can be carried forward indefinitely. There is no time limit.

I know that it is a lot to take in. Let’s see this through an example.

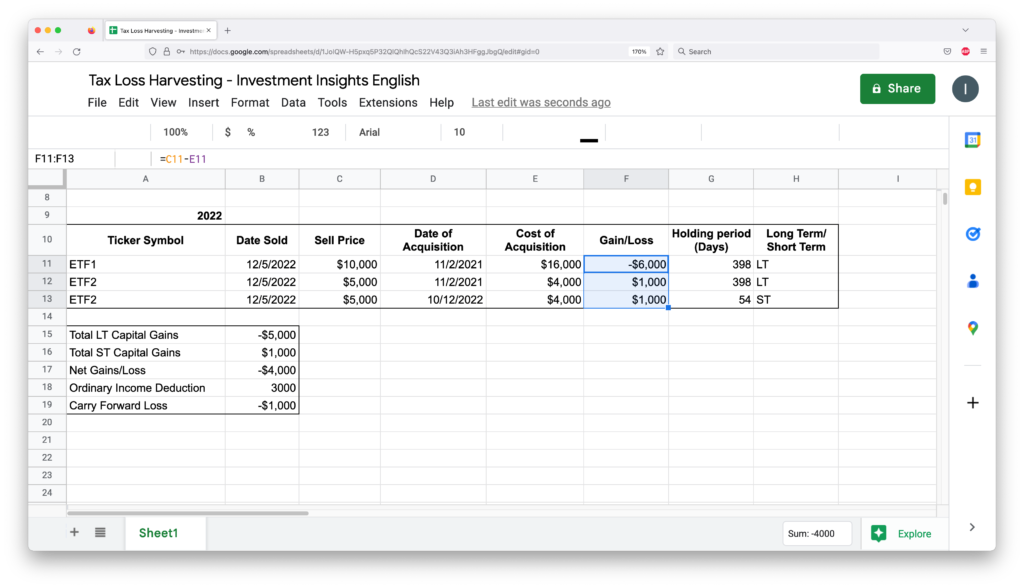

You make 3 trades in the year 2022. A long-term loss of 6000 dollars, a long-term gain of 1000 dollars, and a short-term gain of 1000 dollars.

The long-term gain 1000, can offset, part of the long-term loss 6000. So that would result in, a net long-term loss of, 5000 dollars.

But we still have a short-term gain of, 1000. The rest of the long-term loss, can offset this short-term gain as well. So the final loss comes out to be, 4000 dollars.

The whole 4000 dollars loss, cannot be deducted from our regular ordinary income. IRS lets us deduct, only up to 3000 dollars of capital loss per year. But we can carry forward, the rest of the loss 1000 dollars, to the next year.

So if your regular income is 100K, then you can deduct your loss 3000 from 100K, and pay income tax only for, 97K.

Now you should have a good understanding of, how long term and short term capital gains tax work.

Tax loss harvesting

Tax loss harvesting is a strategy that we can follow, to minimize the capital gains tax, by offsetting capital gains, with capital losses.

For example. Say that you sold a few securities in your portfolio, and realized a total long-term capital gain of, 5,000 dollars. Then you have to pay a long-term capital gains tax rate of, 15% on those gains, which will be, 750 dollars.

But if you already have securities in your portfolio, that are at loss, then you can sell those and realize the loss, so that you can offset these gains. If the total loss is 5,000 dollars, then you have 0 gains for the year and so no capital gains tax. You saved 750 dollars.

Not bad huh. But there are a couple of problems with this approach. We cannot buy the same security that we sold for a loss, for another 30 days. That means, if I sold the ETF QQQ for a loss, and if I want to show that as a loss in my tax return, then I should not buy QQQ again, for the next 30 days. It is called the wash-sale rule.

If I buy QQQ within next 30 days, then I cannot claim the previous loss in my tax return.

A long-term investor should always be invested. We cannot sit out of the market, even for a few days. But this wash sale rule is, forcing us to sit out of the market for 30 days. What can we do? There is a workaround. Instead of buying the same ETF, we can buy something similar, but not substantially identical.

For QQQ, we can potentially replace it with VGT – vanguard’s Technology fund. But we cannot replace, QQQ with QQQM, as they both are substantially identical.

So we do have a workaround for the wash sale rule. The second problem with Tax loss harvesting is, we are not actually saving the tax. We are just postponing the tax payment. That is all. This might come out as a surprise for many.

Let’s look at an example to understand this better.

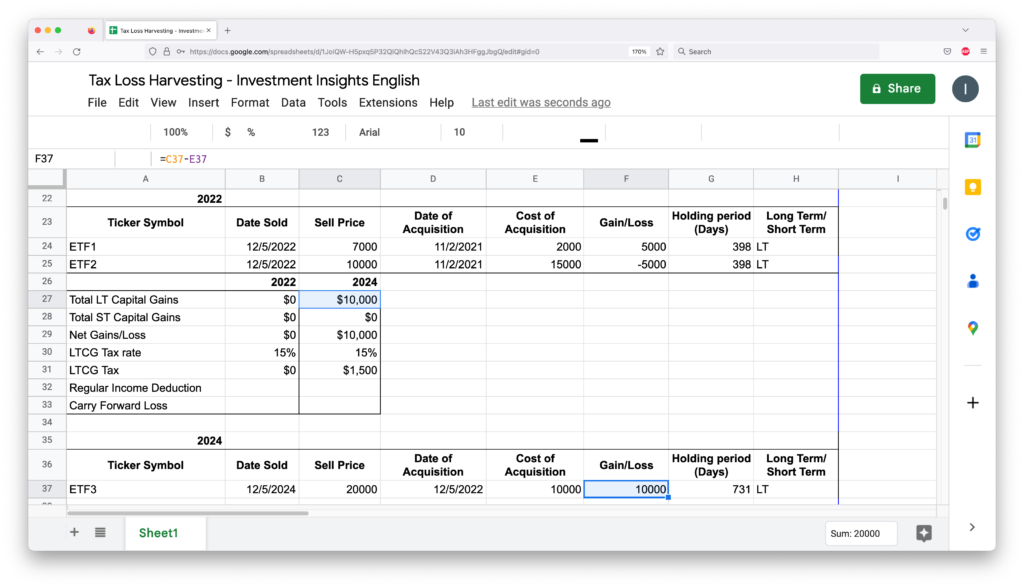

We sold ETF1 to realize a profit of 5000 dollars. We have ETF2, which is at a loss of 5000 dollars. To avoid paying tax for the 5000 dollar gain, we are going to sell ETF2 at loss. Now we have 0 gains for the year and so no capital gains tax. Well and good.

But by selling ETF2, we get 10,000 dollars in hand. We use that money to buy, another similar ETF – ETF3. Let’s say that we hold this ETF3, for the next couple of years. In these 2 years, the ETF3 has doubled in price.

We decide to sell this ETF3 in 2024. Now the profit is 10,000 dollars. If we have held on to ETF2 without selling, that would have raised to 20,000 as well. Its profit would have been, just 5,000 dollars, as the cost of acquisition is, 15,000 dollars for ETF2.

But because we switched ETF2 with ETF3, we end up with a bigger profit of 10,000 dollars. So the 5000 capital gains we saved in 2022, will catch up in 2024.

That is why we are saying, tax loss harvesting is not actually saving taxes, but just postponing the tax payment.

But still, under certain circumstances, we can use tax loss harvesting to our advantage.

We can try to deduct, 3000 dollars of capital loss, from our regular ordinary income every year.

Let’s say that you own some securities that are at loss. You can potentially sell them, to realize a loss of up to 3000 dollars, and replace them, with something similar, but not identical.

Now this capital loss of 3000 dollars, can be reduced from your ordinary income. That means, if your marginal tax rate is 24%, you are saving 720 dollars. Higher your marginal tax rate, higher your savings.

This is one strategy. Another strategy is, to extend this for multiple years.

Say that you have a capital loss of, 5000 dollars in your portfolio. What you can do is, you can sell your holdings, and realize the 5000 dollar capital loss now. Get the tax deduction for 3000 dollars this year, and carry forward the remaining 2000, into next year.

Assuming that you do not have any other losses, you can deduct this 2000 from your income next year.

If your loss is huge, you can repeat the same process for multiple years. Because we can carry forward the losses indefinitely.

Another reason to do tax loss harvesting is, for rebalancing your portfolio. Let’s say that you have huge gains from one single stock X. May be because you are holding it for a long time or from your RSUs. But it makes up a big chunk of your portfolio. If you have losses from other securities in your portfolio, this is the time to rebalance. You can sell some of the stock X for gains and offset those gains by, the losses from other securities. This will help you to reduce, the concentrated risk in your portfolio.

But if you do not have any losses to compensate for the gains, then you cannot really do anything to save taxes.

Hope this is helpful.