Do you know the difference between, a marginal tax rate, and an effective tax rate. It is very important, that we understand the difference. It will be of huge help, with our tax planning.

What is Marginal Tax rate?

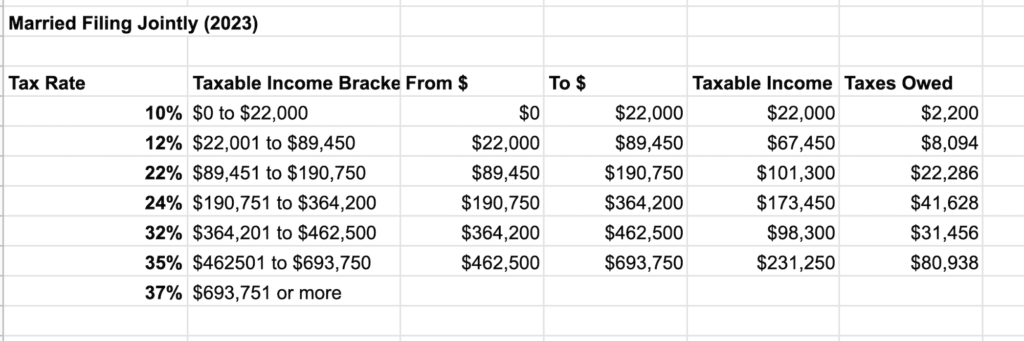

To understand that, we should know, how our income is taxed. What we are seeing here is, US tax brackets for 2023. Though I am showing US example here, the concept is essentially same for India as well.

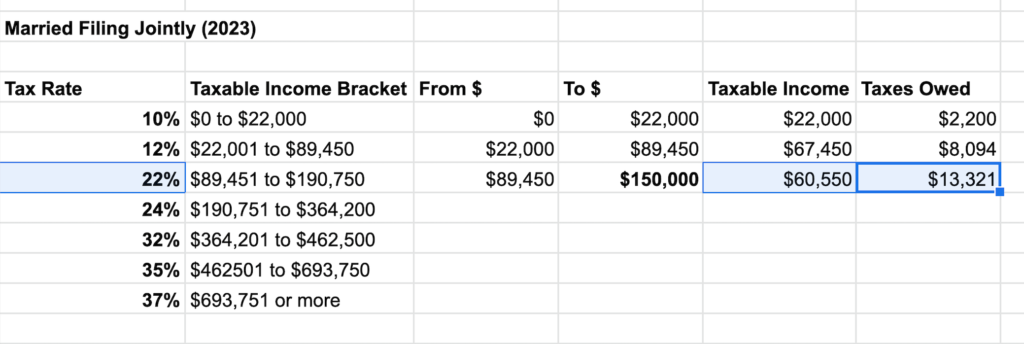

Let’s say that your family’s total income is, $150,000 dollars for the year. The whole 150,000, will not be taxed at the same rate. There are different tax rates, for different brackets of the income.

For married, Filing jointly – the first 22,000 of the family income, will be taxed at 10%. So that would be, 2200. From 22,001 to 89,450, it will be taxed at 12%. Note, how the 12% tax rate is applicable, only for any income over 22,000, and not for the whole 89,450. This is an important difference that we should remember.

The next tax bracket is 22%, which is applicable only for, any income over 89,450, but less than 190,750. And we can see, as the family income increases, and crosses a tax bracket, the additional incremental income is, taxed at a higher tax rate.

So for our example of 150,000 family income, the first 22,000 will be taxed at 10%, the next 67,449 will be taxed at 12%, and the rest 60,549, will be taxed at 22%.

The tax rate of your top most dollar, that is the tax rate of the last dollar you earned in that year, is, your marginal tax rate. So in this example, the top most dollar is taxed at, 22%. So your marginal tax rate is, 22%.

The total taxes owed for this example is, 23,615 dollars. That will be, 15.74% of total income 150,000. So you will be effectively paying, 15.74% tax rate. This is Effective tax rate.

So for 150,000 dollars family income, the marginal tax rate is 22%, and the effective tax rate is, 15.74%.

Why is this marginal tax rate important? Whenever you contribute money to any tax advantaged account, like a 401K, IRA or HSA, you are saving at marginal tax rate, because you are contributing the money from your, top most tax bracket.

For example, for your family income of 150,000, if you maximize your 401K, by contributing 22,500 dollars, then you are saving, 22% of that contribution on taxes. which is, 4950 dollars.

If you are in a higher marginal tax bracket, your tax savings is even more. Say that your family income is 400,000 dollars. Then your 401K contribution of 22,500, will save you 32% on taxes, which is, 7200 dollars.

Hope this helps to understand, how much money you save on taxes, when you contribute to a tax advantaged account.

I’m impressed, I have to admit. Seldom do

I come across a blog that’s both equally educative and entertaining, and let me tell you, you’ve

hit the nail on the head. The problem is an issue

that not enough men and women are speaking intelligently about.

I am very happy I found this during my search for something concerning

this.