When it comes to investment, the first concept that we need to understand is the Power of Compounding. Many quote that Einstein himself has said “Compounding is the eighth wonder of the world”. Regardless of whether he has actually said that or not, it is actually an amazing thing. Understanding that is the foundation of investing, over which we can build many creative wealth building strategies.

We have learned about Compound Interest in school. But whether we understood its full potential is questionable. It is very easy for us to think linearly. Let’s say that we earn 1 rupee or dollar every day. How much would we have earned by the end of 10 days? We can easily say that it is 10, as the calculation is linear. But let’s say that we have 1 rupee/dollar and it doubles every day. How much money would we have earned by the end of 10 days? The question might look simple, but this is not an easy question to answer unless we are a mathematic genius like Sakunthala Devi. Try it out and write down your guess on some paper.

Doubling it everyday looks like this:

2, 4, 8, 16, 32, 64, 128, 256, 512, 1024

How close were you with your guess? If you were pretty close, then you are probably an exponential thinker. Not many of us would have come close to the actual answer. There are three key lessons that we can learn from this number series.

Lesson #1:

Any investment that doubles 10 times becomes 1000 times the original investment. What does that imply? If I invest ₹1,000 in something today that can double every 5 years, then in 50 years, that ₹1,000 would have become ₹10 lakhs (₹1 Million) without any new additional investment.

Lesson #2:

The first double actually made just 1. But the 10th double made 512 to make the total 1024. What does this mean? Patience is the biggest asset for a successful investor. The longer we wait and let our investment compound, the bigger the benefit will be. The 11th double in this series will be 2048, a gain of 1024. And this is why saving as early as possible for our retirement is key to build a solid retirement portfolio, as it allows for more time for the money to compound.

Lesson #3:

It is the same effort to double 512 to 1024 as 1 to 2 – nothing different. However, only if we had saved the ₹1 in the first place, then we would have the option of making ₹1024 down the road. Thinking long term in our financial decisions is another key characteristic of a successful investor.

A Practical Example

Now let’s see how compounding works using a practical example.

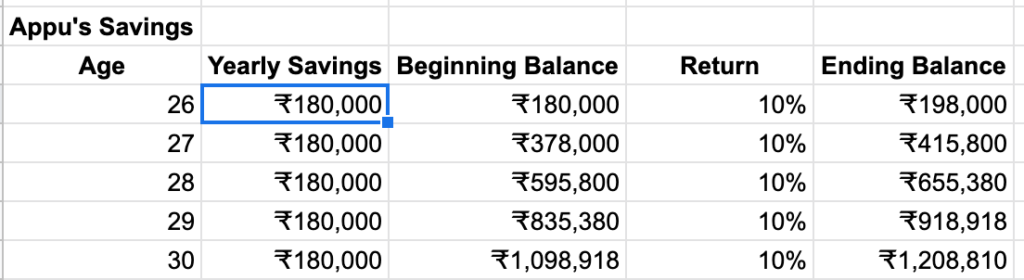

Appu is a 25 year old who has just joined his first job. His take home salary is ₹30,000 per month. He grew up knowing the power of compounding and is fully determined to take full advantage of it. So, he saves his income and invests 50% of his earnings in an index fund which is expected to give a 10% annual return. (i.e. he saves and invests ₹1,80,000 every year for a return of 10%). By the end of the next 5 years, he will have a net worth of ₹12 lakhs.

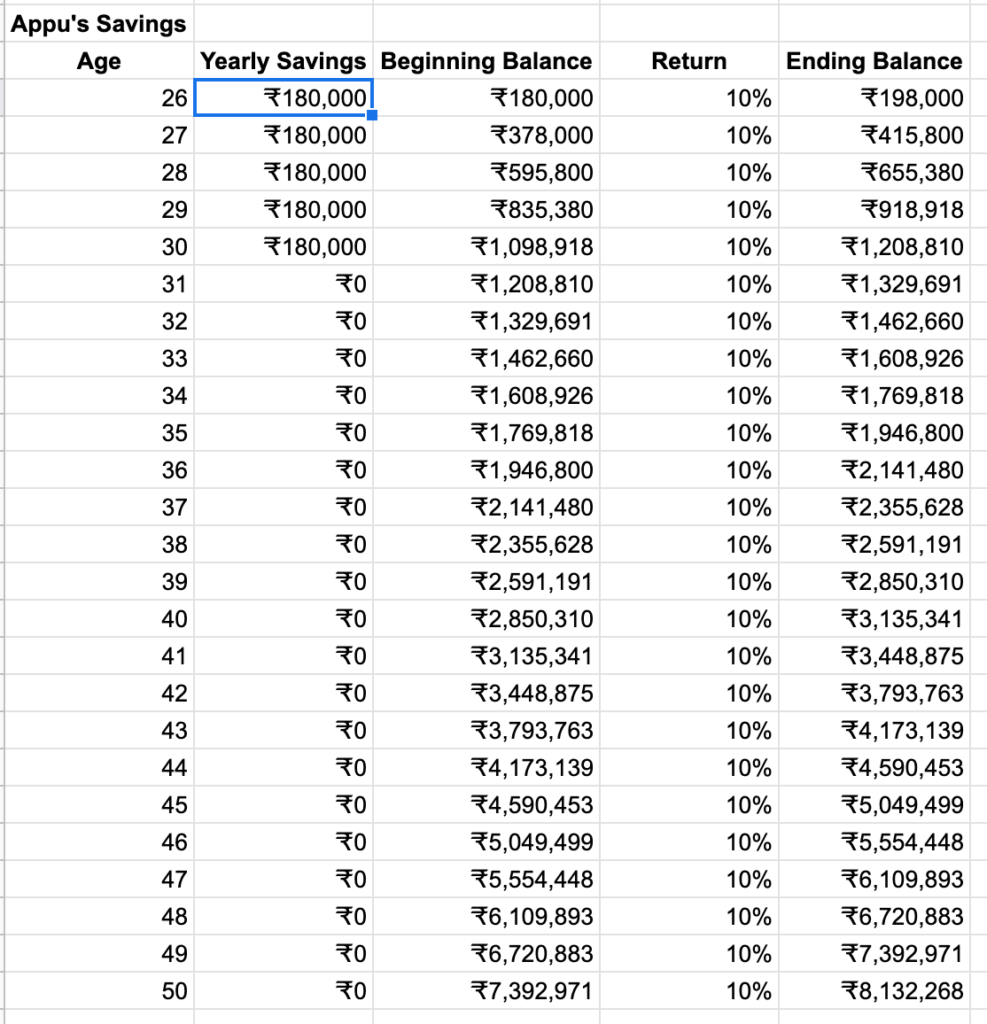

After he turns 30, he decides to get married and have kids. With this new expanded family, he is not able to save as aggressively as before. He ends up saving nothing after 30. But he lets his original investment compound. When he is 50, he will have a solid ₹81 Lakhs (₹8.1 Million) in his retirement portfolio. Just by saving aggressively when he was young, Appu was able to build his portfolio, even though he was not able to save a single paise after 30.

Note: For simplicity sake, we are assuming a steady return of 10% every year. But in real life, that return fluctuates every year.

There are three key parameters in the compounding calculation that has an influence on the final outcome.

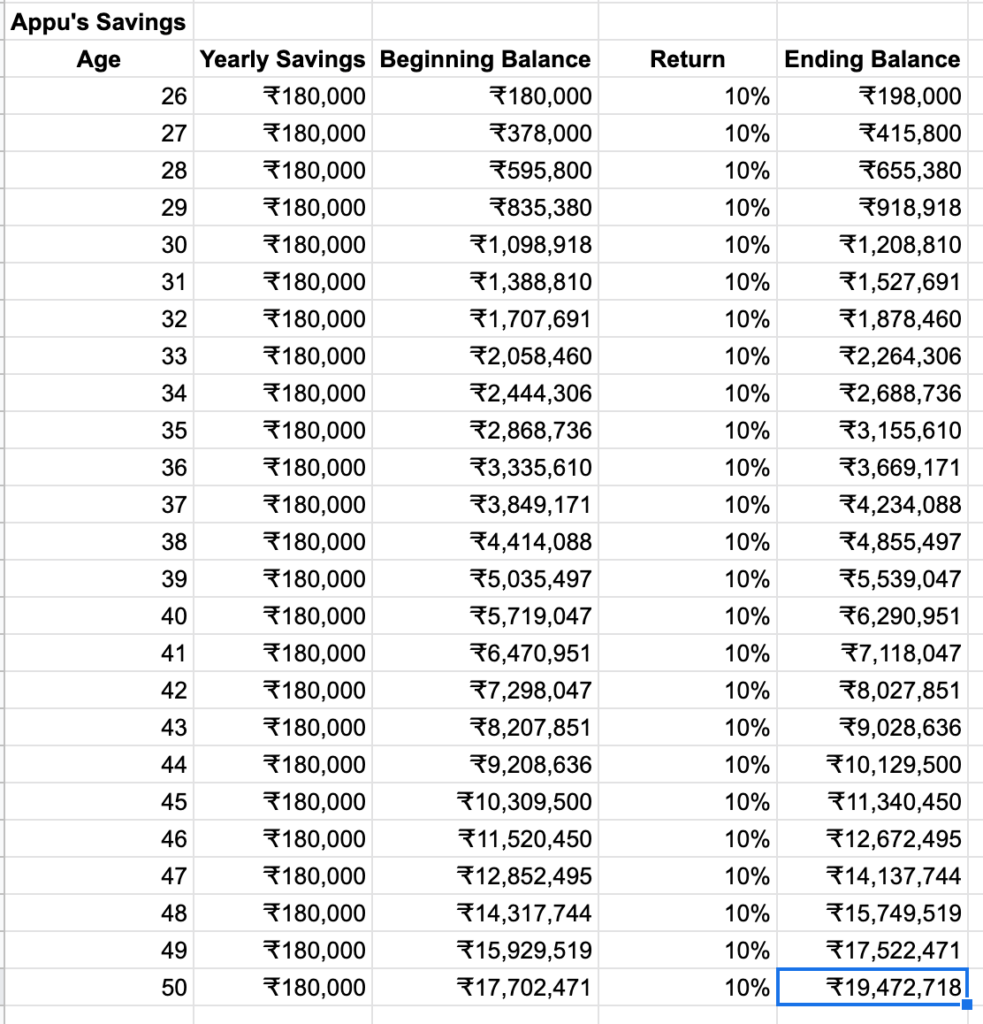

1. Amount of savings

Depending on the amount of yearly savings, the final outcome will change drastically. In Appu’s example, even though his expenses go up with expanded family, his earnings would have grown as well, as he grows in his career. His spouse could be earning for the family as well. So, what if he was able to save ₹1,80,000 every year until he is 50? Now the final portfolio value when he is 50 jumps to more than double his previous amount, ₹81 lakhs, to ₹1.95 Crore (₹19.5 Million).

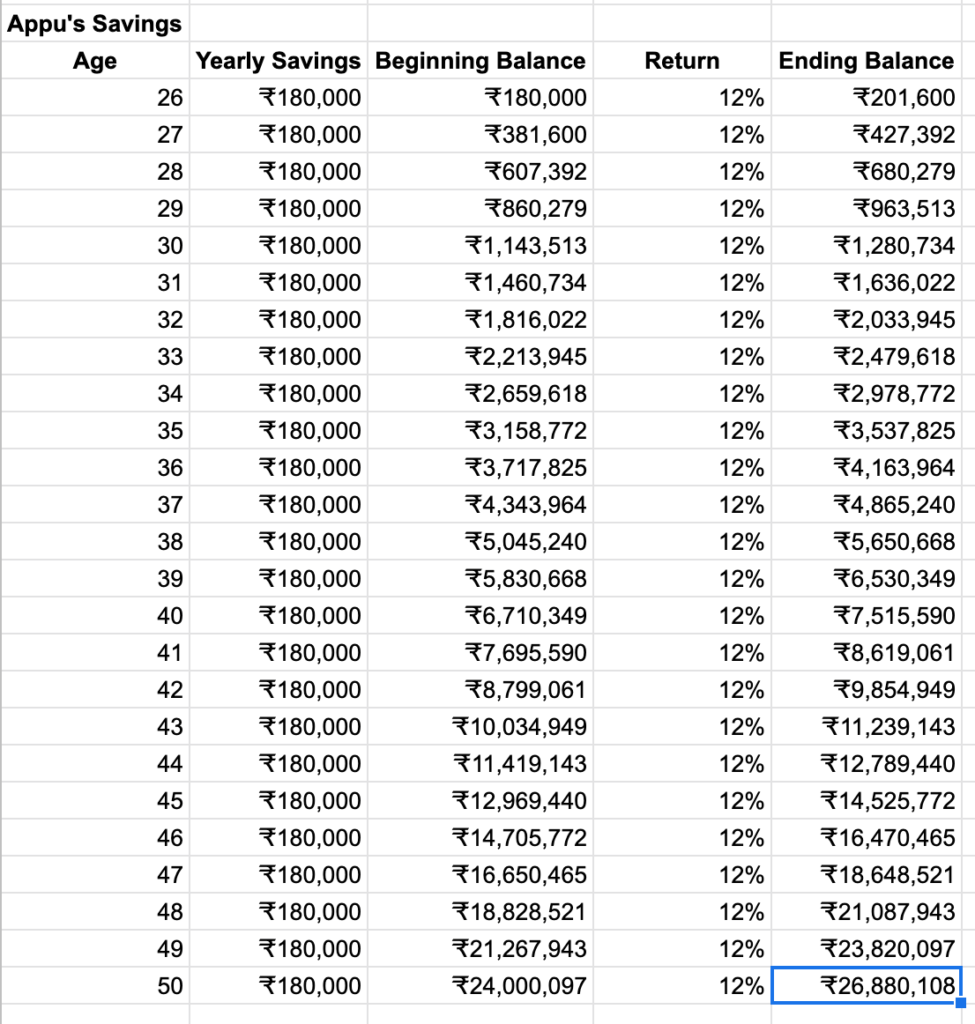

2. Return Rate

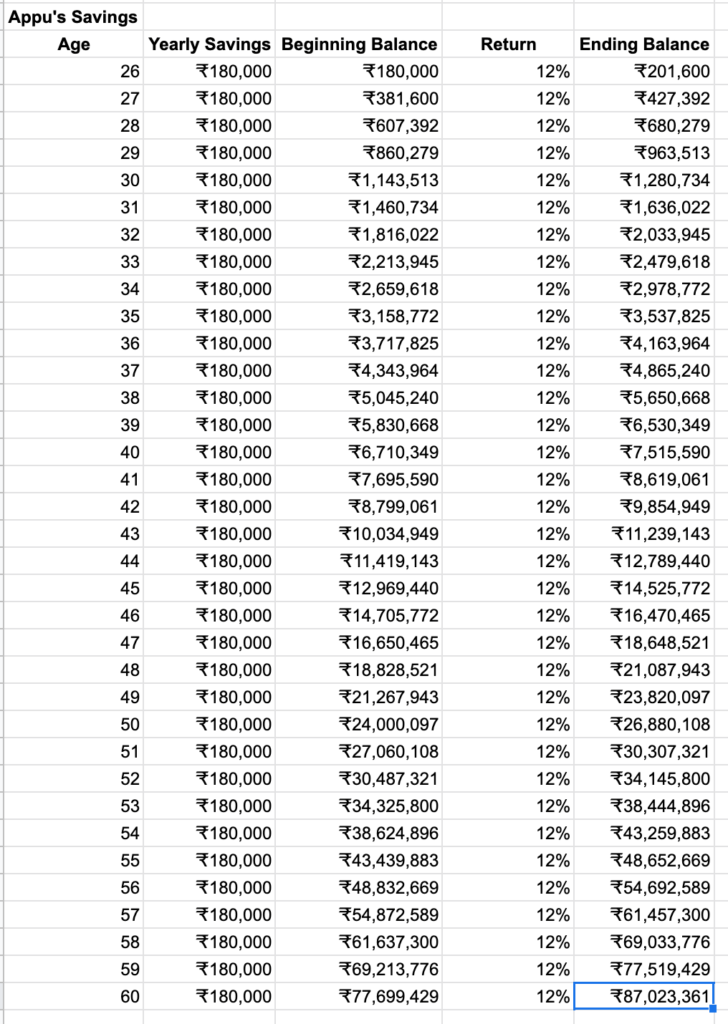

Return rate has a big impact on the final outcome as well. If Appu’s investment turn out to grow at 12% instead of 10%, then he would have ended up with ₹2.69 Crores (₹26.9 Million) instead of 1.95 Crores. This is why it is important to choose our assets wisely for our investments.

3. Invested Period

As we already saw, the amount of time the money is invested has a huge impact on the final outcome as well. If Appu decides to work until he is 60 instead of retiring at 50, then his final portfolio value would have been ₹8.7 Crores (₹87 Million) instead of 2.69 Crores.

I hope this post helped you to understand the Power of Compounding. So, think twice before you splurge your money on that latest iPhone or a fancy motor bike.

Check out this wonderful article in “Get Rich Slowly” that digs deeper into the power of compounding with wonderful illustrations.

You can use this quick online calculator to calculate your compounded growth.

If you like this post, please share it with your friends and family using the following social media links. Thank You!

Great start. Loved your style of narration on YouTube. Looking forward to awesome blog posts as well. Keep the good work going.

Thank You!

I too agree that your narration style is superb,keep it up,thanks

Wonderful job sir thank you for all your insights

Thanks for the detailed explanation. One question: Which are the financial instruments uses compound Interest where we can invest?

Thanks for inspiring us to save and become financially independent

You are such a great inspiration, Vijay! Thank you for helping so many families!

Thank you so much, sir! It is very useful for planning our life.

Hello Sir,

I am regularly watching your you-tube videos,all are so awesome,poeple like you are much need to this modern society to create wisdom among people about investing and financial freedom.

You brought me confidence in my life which also creates enthusiasm to earn and invest more.

Keep up the good work and continue educate people,Thanks much !!

Thanks

Ramesh

Impressive and comprehensive article, if possible try in Tamil sir. In our Tamilnadu, many ppl doesn’t know and also don’t want to try zerodha varsity bcoz it’s in English language.

We have the YouTube channel “Investment Insights” for Tamil. Check it out.

Simply Super sir. Great going. Keep it up. God bless you

Short read is neatly drafted with Tables & Illustrations.

Don’t Stop Videos. Blog will be used as reference for better understanding of the subject.

Keep Going Sir !

Very good one ! Well explained in a simple and powerful way. Great initiative . Appreciate your service.

Such a nice article Mohan; thanks a lot for providing the inspiration using simple examples. Advance Happy New Year…

Nice article

Dear sir,

Watched your YouTube video on whether to rent or buy a house and I have a pressing question.

If an individual has 50 lakhs savings to buy a house which has a potential of 15000 per month as rent ( price to rent ratio 28) and the flat is in a prime location. Is it still not a good idea to buy because the ratio is above 20? Especially he’s not going for a loan? and considering the appreciation value due to the location etc.,

Kindly request you to explain.

Many thanks,

It is totally personal choice. There is nothing right or wrong about it. Go with what you like. But from purely financial perspective, it does not look like a profitable one.