Buying a home is not an easy decision. It just involves too many factors to consider. But, there are a few “don’ts”, that you need to be aware of, before buying a home. Those can help you in making an informed decision. We are going to take a closer look at them in this episode.

Rent Savings

Don’t buy a home, thinking that you can save on your rent. This might come out as a shock to many. Almost everyone believes, that paying rent for a home, is like throwing away money. But is that true? If we own a home, we do not have to pay rent. True. But at what cost?

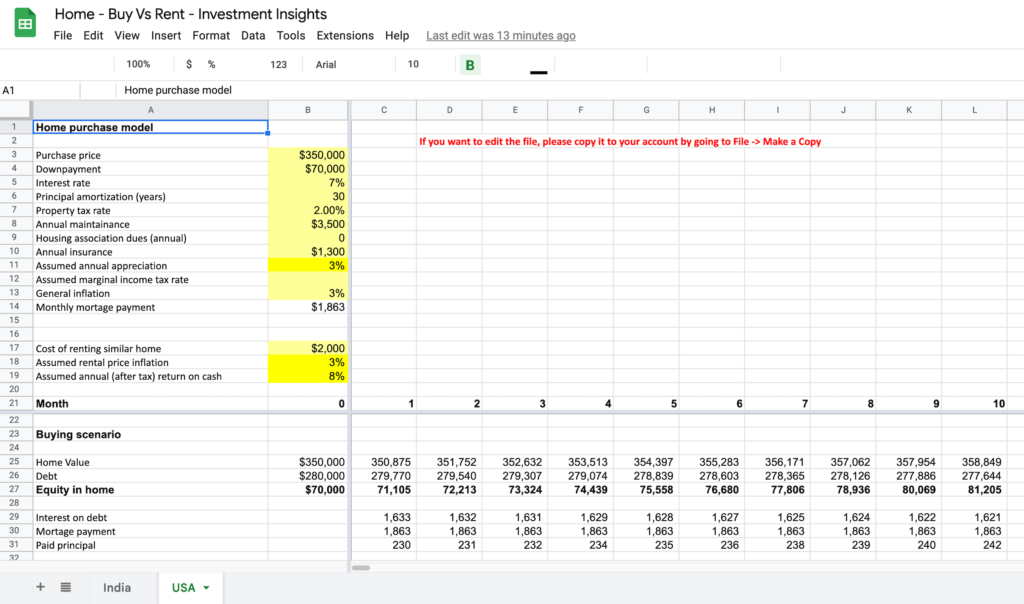

Let’s say that I buy a house for, $350,000. I make a 20% downpayment, or $70,000 dollars. Borrowing the remaining $280,000, with a 30-year loan term, at a 7% interest rate. What would be my monthly mortgage payment? $1863.

Do you know how much of that money goes to the principal and how much goes to the interest? Out of $1863, only $230 go to the principal. The rest $1633, goes for interest. That is, only 12% of the payment, goes to the principal. 88% goes to interest. This is for the first month of the loan period. As years go by, more money goes toward the principal. But not by a lot though.

By the end of the 10th year, the monthly mortgage payment is, still the same $1863. But now, $459 go towards the principal. 25% of the payment. This is called Amortization.

If you think about it, it actually makes sense. At the beginning of the loan period, the loan balance is at the maximum. And so, we are paying the maximum interest for the first month. But as years go by, the outstanding loan balance goes down, and so, the interest for the balance goes down as well.

So for our example, I will be paying, $1633 as interest in the first month. And even after 10 years, I will be paying, $1400 as interest. If paying rent is like throwing away money, what do you call this? Donation for a good cause? No. This is throwing away as well.

It is not just the mortgage payment. If you are in the US, you have to add property tax as well. Depending on the place, it could be more than 2% of the property price. For a $350,000 home in Chicago, the property tax goes above $7300 per year. That adds, $608 to the monthly expense.

So for a $350,000 home, we have to spend more than $2000, which does not go toward our home value. In your words, throw away money. So why do we consider paying rent as throwing away money, but paying interest and property tax as a worthy expense? Mental accounting bug? Maybe.

What if I am not taking the loan? What if I decide to pay the whole $350,000 in cash? Wouldn’t that be better than, paying the rent? Not really. It depends on, what would I have done with this $350,000, if I have not spent that for home. It is called Opportunity Cost. Because I am missing my opportunities, to invest this $350,000 somewhere else.

For example, I could have invested this money in an Equity index fund that gives a 10% return in the long term. That means, on average, I could have gotten $35,000/year, from this investment of $350,000. I have to let go of this opportunity, because I am locking my money in a home. My opportunity cost is $35,000 per year.

Your opportunity cost could be different. What would you do with $350,000? If you are going to hide it under your mattress, then your opportunity cost is zero. Then, maybe you should buy a home.

The lesson here is, paying rent is not throwing away money. It is a utility cost, that we are paying for a place to stay. So do not assume that renting is bad. In the second half of this episode, we’ll take a closer look at a buy vs. rent calculator.

Primary Residential Home as an Investment

Don’t buy your primary residential home, as an investment. It is not. It is a nice place for us to stay. That is all about it. Or in other words, see it as a utility need, just like electricity, water, and gas. So buy a home for your needs. Maybe even for your wants and enjoy it. But do not buy a home, assuming that its price will only go up in the future. It could lead to disappointment. And in some cases, people end up losing their homes. If you are in doubt, ask folks who have lived through the US housing crisis in 2008.

I am not saying, do not buy any home as an investment. I am just saying, do not consider your primary residential home as an investment. There are many Real Estate experts, who buy fixer-upper type homes for cheap. Then they fix them and rent them out for good money. Those are good investments. Not your primary residential home. But if the price of your home goes up in the future, treat that as a nice bonus. Just don’t expect that to happen.

Home expenses < 30% of take home income

Your total expenses to own a home, should not go over, 30% of your take-home income. For example, if your take-home income is $5,000 per month, then your mortgage payment, property tax, and home insurance total, should not go over $1500 per month. Buying a home that goes over this limit, is asking for trouble. It adds unnecessary financial stress to the family. If the home you like is not within your price range, then you need to focus on improving your income, to get to that level.

20% down payment

Don’t buy a home, if you cannot put 20% of the price as a down payment. If you have not saved enough for a 20% down payment, then that by itself is a signal, that you are not financially ready to buy a home yet. Be patient. Save aggressively for your down payment. Then buy the home. Also putting down at least 20%, removes the requirement of, buying mortgage insurance. It saves at least, $3500 per year, on a $350,000 home.

Peer/Family Pressure

Don’t buy a home, because someone you knew has bought it. Buy for your needs. Not to satisfy society. We cannot judge our peers, just from their external appearance. They might live in a big house. Drive a fancy car. But they might be very close to a financial disaster. Who knows. So it is better to focus on your needs, rather than, playing a catch-up game with your peers. Personal Finance is truly personal. Make it personal to you.

short term Stay

Before buying a home, you need to be sure, that you are going to stay there, for at least 7 years. If you have too many uncertainties going on, because of your job or visa situation, it is better to wait it out, till you know for sure that you will be here for the long term. Selling a home in less than 7 years, most often results in a loss. So be patient, till you have a solid plan for a long-term stay.

Tax Savings

Don’t buy a home to save on taxes. Now in the US, Mortgage interest can be deducted from tax, only if you are using itemized deductions. As the standard deduction for a family is big enough, not many have the need to use itemized deductions nowadays. So saving on tax should not be a reason to buy a home. This is true for India as well. It does not make sense to spend many lakhs in interest to save a few thousand in tax. See tax savings as an additional benefit, that we get from buying a home, rather than a reason for buying a home.

Saying all that, owning a home gives a confidence boost and emotional strength, which cannot be measured at all. There is no way we can account for those in our financial calculation. So yeah, definitely buy a home for your family. Just don’t rush into it or bet everything on it.

Buy Vs Rent Calculator

Now let’s take a look at the Buy Vs Rent Calculator. This is created by someone during the good old days of Fatwallet finance forums. If you are wondering how much money you can save from buying a home, rather than renting, then this calculator is for you.

If you need help using the calculator, watch the video above. It has clear instructions on how to use the calculator.

Hope this is helpful for making an informed decision about buying a home. See you all soon in another episode. Thank You.