Today we are going to cover an important topic. Life Insurance. Many don’t even have, any type of life insurance, not realizing the risk they are putting their family in. Among people who do have life insurance, some assume that the life insurance provided by their employer is good enough. But is it? Even people who realize the importance of good coverage, choose the wrong type of life insurance for their needs. So how can we buy a good life insurance? We will take a closer look at that in this episode.

Who should buy a life insurance?

If you have family members who are financially dependent on you, then you should definitely have a life insurance. If something happens to you, your family can miss you emotionally. You cannot do anything about that. But financially, they should not miss you at all. You have the option to protect them from that disaster. Buying a life insurance. Even though it is an option, do not leave it as optional. I see at least, one “go fund me” request every week to help out a surviving family. I would hate to put my family in that situation. I am sure you are as well. So treat Life Insurance as a must, rather than as an option.

How much coverage do you need?

Your employer might already provide a coverage of up to, two or three times your annual salary. Is that good enough? No way. How long, would that money last for your family? 3 years maybe? Maybe a little longer. After that? That is why, you need a coverage of, at least 25 times your annual expenses.

Let’s say, that you have an annual expense of, 50,000 dollars on average.

Then you would need a coverage of, 25 times 50,000, 1.25 million dollars. This calculation is, the same for India as well. If your annual expense is 5 lakh Rupees, then your coverage amount should be, at least 1.25 Crores. This is the absolute minimum need. More the better.

Why is it a multiple of annual expenses, rather than annual income? Because, the amount of money we spend to run our family would be our need. Not the money we earn.

But why 25 times? It comes from the 4% withdrawal rule. The idea is, the surviving family can invest the insurance payment in something, that gives, at least 4% growth. And that 4% growth is, withdrawn every year for family expenses. So if the family gets 1.25 million dollars, they can invest the 1.25 million in something, that gives at least 4% growth. And they can withdraw 50,000 dollars every year for their annual expenses. What that means is, the 1.25 million dollars will last forever. And so the family would never miss you financially.

What if you have already saved some money? Then that reduces your coverage need. Say if your savings and investments are 250,000 dollars, then you can take this 250,000 dollars off, from your coverage need of 1.25 million. So your coverage need would become, 1 million.

How many years do you need the coverage for?

Many buy the coverage for their whole life. But is that necessary? Not really. Life insurance is meant to protect your family, during your potential earning years. Not after your retirement. What is your plan to provide for your family after your retirement? If you are a financially savvy person, you would have paid off all your debts, including your house loan by then. Kids will also be independent. And so the annual expenses after retirement, will be very low. You will be using your retirement savings, to support you and your spouse.

That means, if something happens to you after your retirement, your family is not going to miss you financially – assuming you have good retirement savings. If that is not the case, you have a retirement savings problem, which we will address in a different episode.

What I am saying here is, you do not really need life insurance coverage, after your retirement years. So buy the coverage, only till your retirement age. Say that you are 35 now, if you are planning to retire by 60, then you need life insurance coverage for only, 60-35, 25 years. Nothing more than that.

what kind of life insurance should you buy?

All you need is a, simple, plain, Term insurance. Nothing fancier than that. Term insurance provides only one function, life insurance. That is exactly what you need. You don’t need, whole-life coverage, minimum return guarantee, cash equivalent, or any other bells and whistles. They are all there in the market for, one and only reason. To make money, out of innocents.

Don’t fall for that. Keep it simple. Just buy a, simple and straightforward term insurance. It is so cheap, that no other insurance plans can come close to it. A healthy 35-year-old, can buy a term insurance, with 25 years and 1 million dollar coverage, for just 50 dollars a month. Let me repeat – 1 Million dollar coverage, for 50 dollars a month.

How much does a whole life insurance cost for the same coverage of 1 million? More than 1000 dollars per month. 20 times more than the term insurance premium. But Vijay, though we pay more, it has a cash value. In 20 years, the cash value will be, more than the total money we would have paid. Isn’t that a better deal? It would seem so. Until we take a closer look at the numbers.

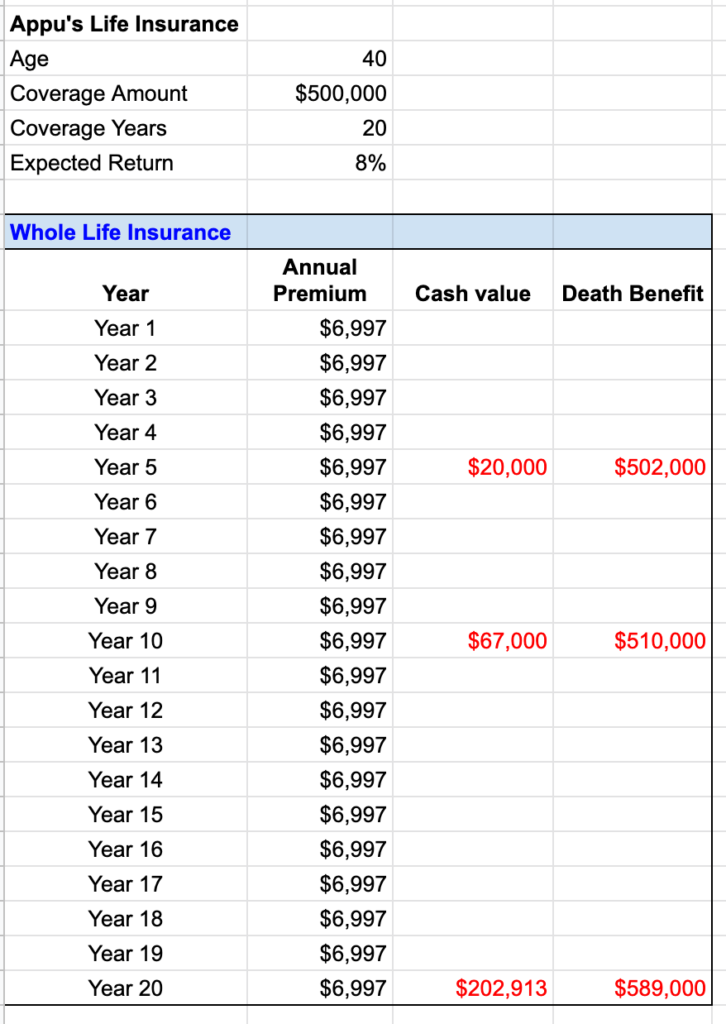

Let’s say that Appu is 40 now. He is buying a whole life insurance, for 500,000 dollars coverage. That would cost him, 6997 dollars per year. I have made some rough calculations for the cash value, based on the numbers I got from Investopedia. It will be 20,000, by the end of year 5. Cash value here means, if you surrender the insurance at that point, this 20,000 is the amount, you will get back from them. If something happens to Appu in the 5th year, they will pay the coverage amount 500,000 + part of the cash value. So a total of, 502,000 dollars.

By the end of the 10th year, the cash value of the account grows to, 67,000 dollars. And the death benefit grows to, 510,000 dollars. By the end of the 20th year, the cash value grows to 203,000 and the death benefit grows to 589,000 dollars.

So in 20 years, we would have paid a total of, 140,000 dollars, but the cash value of the account is 203,000 dollars. If we decide to close the plan at that point, we will get the cash value – 203,000 dollars. Sweet. This is exactly how the agents will frame it to us. And it is very convincing, right? This is called framing bias. The data is framed and presented in a way, so that we are easily convinced.

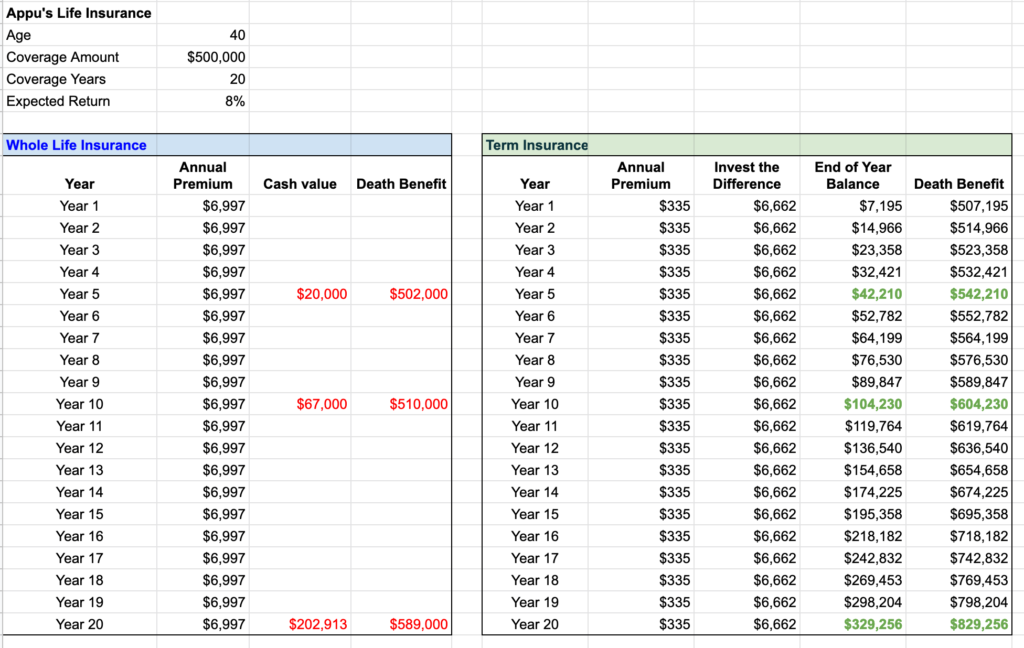

Now let’s see how this compares to a Term insurance. Appu is buying a term insurance, for 500,000 dollars, and for 20 years, till his retirement at the age of 60. The average annual premium Today, for that coverage is – 335 dollars. Note, this is annual premium. Not monthly premium. Right off the bat, you can see the price difference. 6997 Vs 335 dollars.

You say that there is no cash value in Term insurance. But the money you saved, is the actual cash value here. So by buying a term insurance, instead of a whole life insurance, Appu is saving 6662 dollars per year. Is he going to leave those savings in his savings account? No way. He is going to invest that money, in an equity index fund, like the Vanguard Total Stock market index, which can give a long-term growth of, 10% per year.

But let’s assume, that he gets 8% growth every year. By the end of 5th year, he will have a balance of, 42,000. That is 100% more than, the 20,000 in the whole life insurance scenario. His death benefit will be, 542,000 at that point – 500,000 from the insurance, 42,000 from the investments.

By the end of the 10th year, the cash balance will be, 104,000 dollars. And by the end of the 20th year, it will be at 329,000 dollars.

Do you see what’s going on here? In a whole life insurance scenario, they are collecting big premiums. But only a small part of that premium, actually goes for our insurance cost. A big chunk is going for, investments managed by them.

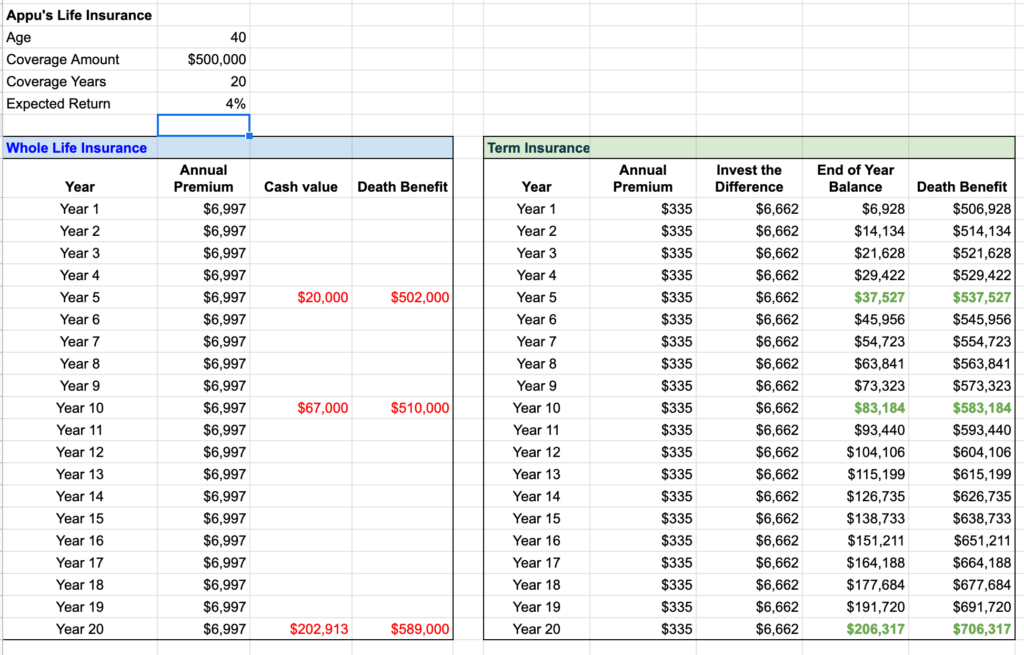

If we change the return rate of investments managed by us to 4%, we can see the cash balance of term insurance, coming close to what we see in whole life insurance. That means, the whole life insurance is paying, close to a 4% return for the example numbers we have used here.

This is just an example. You can plug in your own numbers, and compare the cash values between any other insurance and Term insurance. So you can ask a couple of questions to yourself, before making the decision. Would you be able to beat the return rate offered by the whole life insurance? In Appu’s example, that is 4%. I say, Yes. But if you don’t think that you can, then maybe Whole Life Insurance is for you. But then you need to ask the second question – would you be able to pay the high premium they are asking for? Remember – our primary goal here is, buying a life insurance for our needs. Not investment. You should not settle for less coverage, just because the premium is high. I know many, who buy whole life insurance for just 100,000 dollars coverage, when their actual need is, more than a million. Don’t be that guy. Buy the cheaper Term insurance instead. That will serve your need.

It is always better to keep insurance needs separate from investments. Never mix them both. When we mix them, we think that we get the best of both worlds. But what we end up with is, the worst of both worlds. So keep your insurance needs, and investments separate. For insurance needs, just buy a simple Term insurance. For investment needs, just invest in an Index fund. It is as simple as that.

In India, there are fancier insurance products like ULIPs. Stay away from them. If you run the numbers for those, just like in Appu’s example, you will see, that it is much worse. If your friend or a relative tries to sell a ULIP to you, just run away in the opposite direction. But do buy a Term insurance. A healthy 35-year-old, can easily buy a term insurance for 1 Crore coverage, with just less than 10,000 rupees per year.

A quick note about the Term insurance. As it is very cheap, buy them for, as long as possible. The premium price will not change during the coverage period. That means, inflation does not affect the premium that you pay, for say, 30 years.

Also, as you get older, the premium for Term insurance goes up. So it is better to, buy now when you are young and lock in the price. Or in other words, buy them as soon as possible, rather than waiting till you reach a certain age.

That’s all folks. See you all soon in another episode. Thank You.