Now that we are approaching the end of the year 2022, you might be wondering, if there is anything that we can do in our portfolio, to save on our taxes. Especially, when S&P 500 has gone down by 17% and Nasdaq 100 by 30%. Yes, there are ways. It is called, Tax Loss Harvesting. But not everyone can take benefit from it. Why? We will take a closer look at it in this episode.

Use this episode as a general guide, to understand the capital gains tax in the US. Not as tax advice. Always check with your tax advisor for your tax planning.

Capital Gains Tax

We will start with, how capital gains are taxed in the US. A taxable event is triggered, only when you sell a security, like a stock or an ETF. Buying a security, or holding a security on gains – they are not accounted for tax purposes at all. But when you sell a security, you are going to realize a gain or a loss. And that is why, it is a taxable event.

When there is a gain, we have to pay tax on those capital gains. There are two types of capital gains. A long-term capital gain and a short-term capital gain.

If you sell a security, that you have held for more than a year, then the gains from that sale will be, a long-term capital gain. But if you held it for less than a year, then the gain will be, a short-term capital gain. The tax rates are different for both.

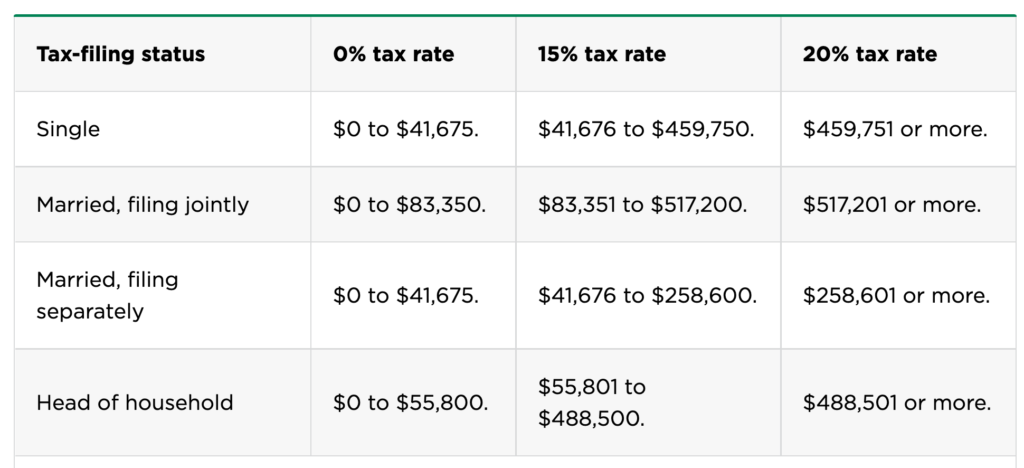

What we are seeing here is, tax rate chart for long-term capital gains. If you are married filing jointly, and if your total taxable income, including the capital gains, is less than 83,000 dollars, then your long-term capital gains tax rate is, 0%.

But if your total taxable income, including the capital gains, is more than 83,000, but less than 517,000, then your long-term capital gains tax rate is, 15%.

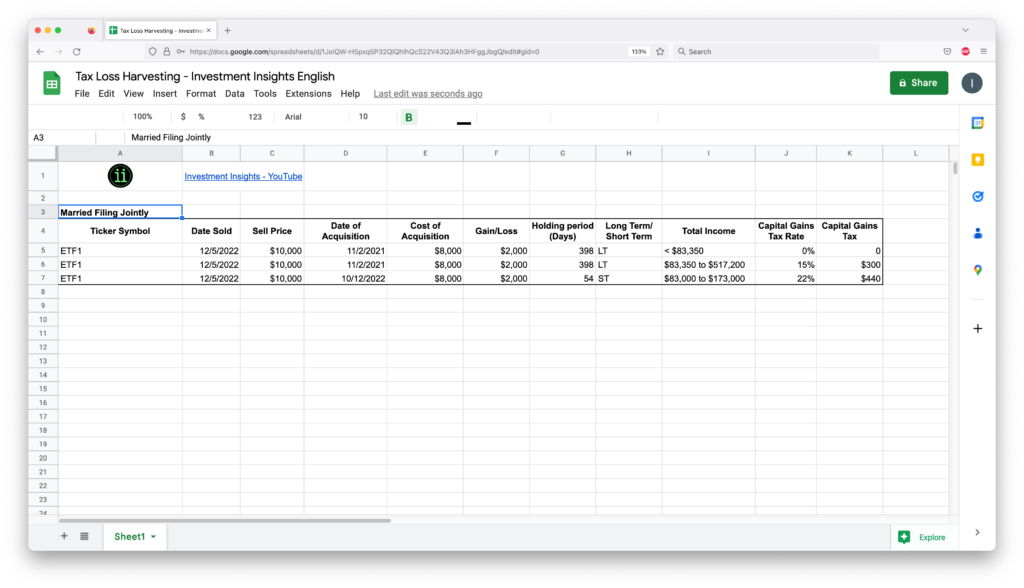

An example can help us to understand this better. Let’s say that you sold an ETF, for 10,000 dollars, on Dec 5th, 2022. You bought this ETF, for 8000 dollars, in Nov 2021. The gain 2000 dollars from this sale, would be a long-term capital gain, because you have held the ETF, for more than a year.

So now when you file the tax return for 2022, you need to report this gain 2000 dollars, as long-term capital gains. Now the tax rate for this gain 2000 dollars, depends on, your total taxable income – including this gain 2000 dollars.

So if your total taxable income, including this capital gain 2000 dollars, is less than 83,000, then you do not have to pay, any tax for this capital gain at all. This is assuming, that your tax filing status is, Married filing jointly.

But if your total taxable income is more than 83,000, but less than 517,000, then your capital gains tax rate is, 15%. That would be, 300 dollars tax on, 2000 dollars gain.

What if you held this ETF for less than a year? Let’s say that you bought this ETF in Oct 2022, for 8000 dollars. You sold this in December, for a gain of, 2000 dollars. Because you held this security for less than a year, you will be paying, short-term capital gains tax rate.

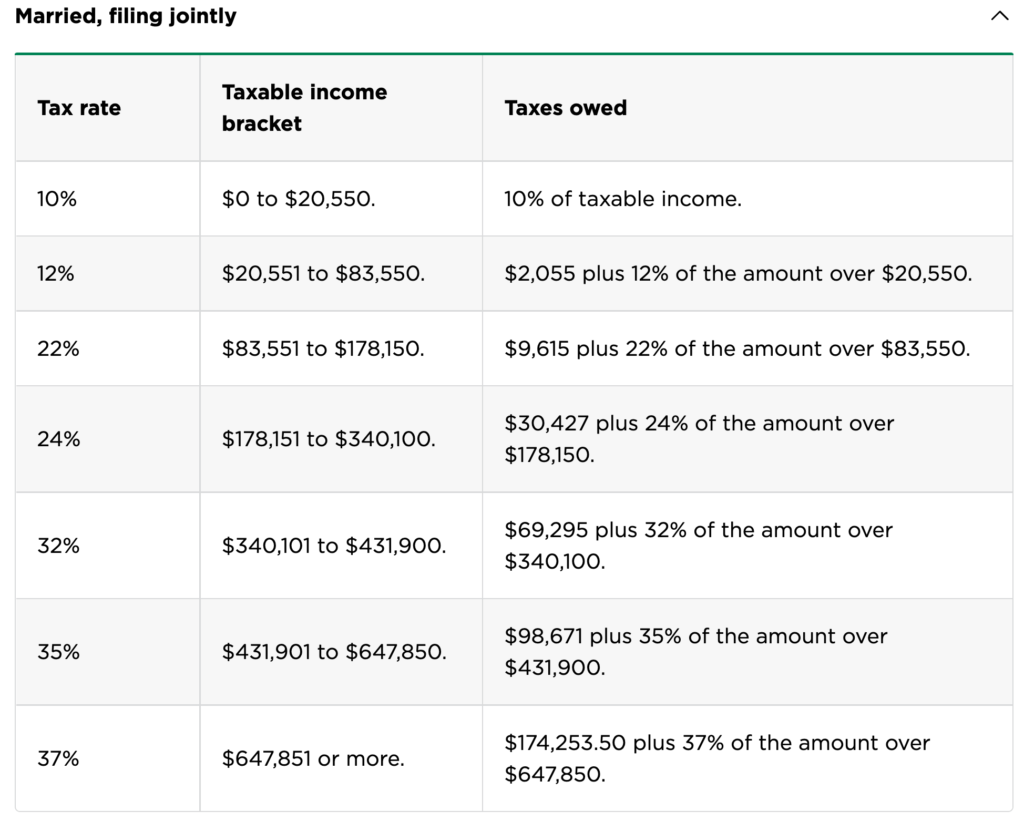

And the short-term capital gains tax rate is, your marginal income tax rate. That means, you will pay tax on the short-term capital gains, as if, you have earned that income from your full-time job.

From https://www.nerdwallet.com/article/taxes/federal-income-tax-brackets

If your family income is between 83,000 and 173,000, then your marginal tax rate is, 22%. That means, you will be paying, 22% tax on any amount, that goes over 83,000 dollars in income. So in our example, the 2000 dollar short-term gain, will be added to your regular ordinary income, and will be taxed at 22%.

If your ordinary income is even higher, then you will end up paying, a higher tax rate for short term capital gains.

This is all good for gains. But what if there is a loss? How do we handle that?

Losses need to be handled in, 3 steps. First – deduct the loss from similar gains. Long-term loss should be deducted from, long-term gains. Short-term loss should be deducted from, short-term gains.

If there are still more losses, then those should be deducted from, any type of other gains. Meaning, a long-term loss can be deducted from a short-term gain, or a short-term loss can be deducted from, a long-term gain.

Finally, if there are still losses left, then up to 3,000 dollars, can be deducted from our regular ordinary income, and the rest, can be carried forward to the next year.

Again in the next year, the same steps are followed. If we do not have enough gains next year to offset the loses, then again, 3,000 can be deducted from our income, and the rest can be carried forward again. Losses can be carried forward indefinitely. There is no time limit.

I know that it is a lot to take in. Let’s see this through an example.

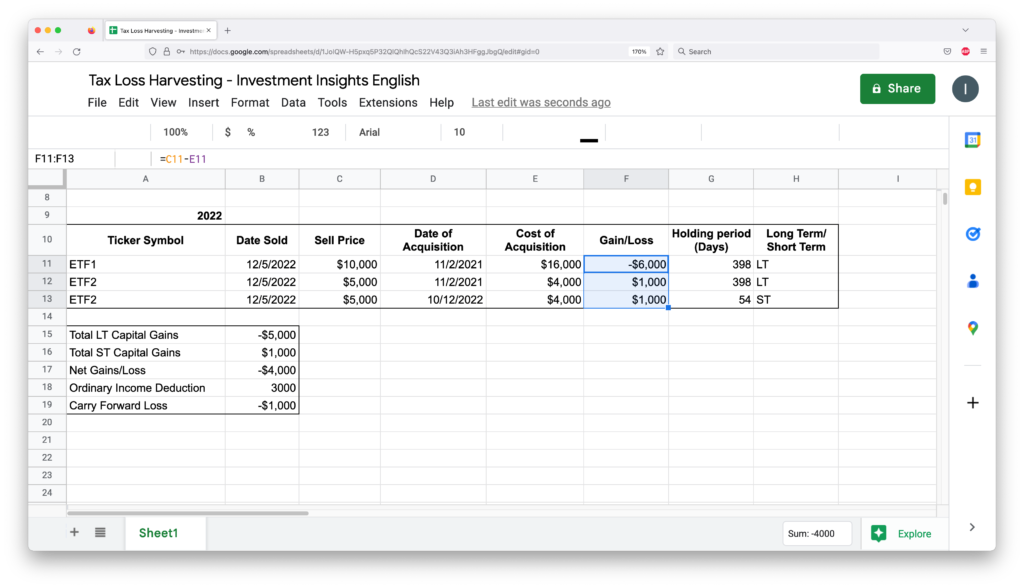

You make 3 trades in the year 2022. A long-term loss of 6000 dollars, a long-term gain of 1000 dollars, and a short-term gain of 1000 dollars.

The long-term gain 1000, can offset, part of the long-term loss 6000. So that would result in, a net long-term loss of, 5000 dollars.

But we still have a short-term gain of, 1000. The rest of the long-term loss, can offset this short-term gain as well. So the final loss comes out to be, 4000 dollars.

The whole 4000 dollars loss, cannot be deducted from our regular ordinary income. IRS lets us deduct, only up to 3000 dollars of capital loss per year. But we can carry forward, the rest of the loss 1000 dollars, to the next year.

So if your regular income is 100K, then you can deduct your loss 3000 from 100K, and pay income tax only for, 97K.

Now you should have a good understanding of, how long term and short term capital gains tax work.

Tax loss harvesting

Tax loss harvesting is a strategy that we can follow, to minimize the capital gains tax, by offsetting capital gains, with capital losses.

For example. Say that you sold a few securities in your portfolio, and realized a total long-term capital gain of, 5,000 dollars. Then you have to pay a long-term capital gains tax rate of, 15% on those gains, which will be, 750 dollars.

But if you already have securities in your portfolio, that are at loss, then you can sell those and realize the loss, so that you can offset these gains. If the total loss is 5,000 dollars, then you have 0 gains for the year and so no capital gains tax. You saved 750 dollars.

Not bad huh. But there are a couple of problems with this approach. We cannot buy the same security that we sold for a loss, for another 30 days. That means, if I sold the ETF QQQ for a loss, and if I want to show that as a loss in my tax return, then I should not buy QQQ again, for the next 30 days. It is called the wash-sale rule.

If I buy QQQ within next 30 days, then I cannot claim the previous loss in my tax return.

A long-term investor should always be invested. We cannot sit out of the market, even for a few days. But this wash sale rule is, forcing us to sit out of the market for 30 days. What can we do? There is a workaround. Instead of buying the same ETF, we can buy something similar, but not substantially identical.

For QQQ, we can potentially replace it with VGT – vanguard’s Technology fund. But we cannot replace, QQQ with QQQM, as they both are substantially identical.

So we do have a workaround for the wash sale rule. The second problem with Tax loss harvesting is, we are not actually saving the tax. We are just postponing the tax payment. That is all. This might come out as a surprise for many.

Let’s look at an example to understand this better.

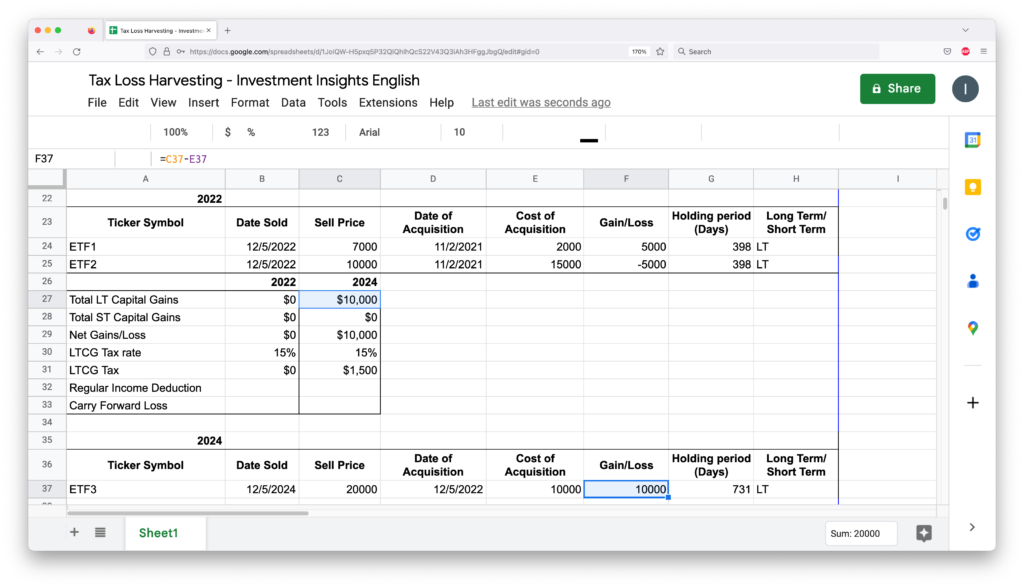

We sold ETF1 to realize a profit of 5000 dollars. We have ETF2, which is at a loss of 5000 dollars. To avoid paying tax for the 5000 dollar gain, we are going to sell ETF2 at loss. Now we have 0 gains for the year and so no capital gains tax. Well and good.

But by selling ETF2, we get 10,000 dollars in hand. We use that money to buy, another similar ETF – ETF3. Let’s say that we hold this ETF3, for the next couple of years. In these 2 years, the ETF3 has doubled in price.

We decide to sell this ETF3 in 2024. Now the profit is 10,000 dollars. If we have held on to ETF2 without selling, that would have raised to 20,000 as well. Its profit would have been, just 5,000 dollars, as the cost of acquisition is, 15,000 dollars for ETF2.

But because we switched ETF2 with ETF3, we end up with a bigger profit of 10,000 dollars. So the 5000 capital gains we saved in 2022, will catch up in 2024.

That is why we are saying, tax loss harvesting is not actually saving taxes, but just postponing the tax payment.

But still, under certain circumstances, we can use tax loss harvesting to our advantage.

We can try to deduct, 3000 dollars of capital loss, from our regular ordinary income every year.

Let’s say that you own some securities that are at loss. You can potentially sell them, to realize a loss of up to 3000 dollars, and replace them, with something similar, but not identical.

Now this capital loss of 3000 dollars, can be reduced from your ordinary income. That means, if your marginal tax rate is 24%, you are saving 720 dollars. Higher your marginal tax rate, higher your savings.

This is one strategy. Another strategy is, to extend this for multiple years.

Say that you have a capital loss of, 5000 dollars in your portfolio. What you can do is, you can sell your holdings, and realize the 5000 dollar capital loss now. Get the tax deduction for 3000 dollars this year, and carry forward the remaining 2000, into next year.

Assuming that you do not have any other losses, you can deduct this 2000 from your income next year.

If your loss is huge, you can repeat the same process for multiple years. Because we can carry forward the losses indefinitely.

Another reason to do tax loss harvesting is, for rebalancing your portfolio. Let’s say that you have huge gains from one single stock X. May be because you are holding it for a long time or from your RSUs. But it makes up a big chunk of your portfolio. If you have losses from other securities in your portfolio, this is the time to rebalance. You can sell some of the stock X for gains and offset those gains by, the losses from other securities. This will help you to reduce, the concentrated risk in your portfolio.

But if you do not have any losses to compensate for the gains, then you cannot really do anything to save taxes.

Hope this is helpful.